Cancer is a big problem in the history of human medicine, and there is no way to completely cure it at present. In the face of cancer with extremely high mortality, life is fragile. No matter whether it is poor or rich, famous or unknown, we often see the news that celebrities have died of cancer, and we can’t help sighing, but there are also some wonderful experiences of anti-cancer success! Many cancer patients often lose confidence in life after learning that they have cancer, do not actively treat them, or even resist treatment, and feel that treatment is unnecessary, and treatment is a waste of money. In fact, this idea is not correct. Don’t give up until the last moment. Even if cancer has not been completely overcome, after scientific and reasonable treatment with many patients, life can be continued, and even clinical cure or long-term survival with tumors can be achieved! Nowadays, there are many treatments for cancer. If it is found as early as possible and treated actively, one third of cancer can be cured. Medical "cure" is different from what people usually understand. The clinical cure here refers to the disappearance of symptoms and signs after treatment, and the tumor can not be found after image review for more than 5 years.

Today, Xiaobian, a cancer-free home, will share the stories of four celebrities who have succeeded in fighting cancer, and see how they fight cancer. I hope to give some reference and motivation to all cancer friends!

Kai-Fu Lee: From the late stage of cancer to the disappearance of tumor, chemotherapy+targeted therapy against advanced lymphoma.

On September 5th, 2013, 52-year-old Kai-fu Lee, the founder of Innovation Factory, announced that he had stage IV follicular lymphoma and had to leave work for treatment. In February 2015, he announced the results of his physical examination, indicating that the tumor in the body is not obvious at present. In June of the same year, Kai-fu Lee said that he had not found any lesions in his last two examinations and ridiculed himself as "Li Kangfu". It took Kai-fu Lee less than two years from finding out the cancer until the focus was completely gone. His anti-cancer experience is worth learning from.

Lymphoma, also known as lymphoma, occurs in the lymphatic system and is one of the malignant diseases of the blood system. In fact, we are no strangers. Besides Kai-Fu Lee, celebrities such as Luo Jing, Asan and Cindy Lee have also suffered from lymphoma. The incidence of lymphoma is actually not too high in malignant tumors, which is about 5/100,000. It can occur at any age, but it is mainly in middle-aged people aged 30-50. The malignant degree of different types of lymphoma varies greatly, which can be roughly divided into: inertia, aggression and high aggression. Inertial lymphoma is similar to chronic diseases, while high aggression is like a "death warrant"! There are many types of lymphoma, but as long as we know, lymphoma can be divided into Hodgkin’s lymphoma (HL) and non-Hodgkin’s lymphoma (NHL), the latter accounting for about 90%, and diffuse large B-cell lymphoma is the main type (40%~50%). When you know that you have stage 4 or systemic metastasis, it doesn’t mean that your condition is very serious and there is no cure. Don’t give up treatment easily. The treatment of lymphoma is mainly systemic chemotherapy and radiotherapy. Li Kaifu’s treatment plan is that bendamustine (bendamustine) is combined with rituximab (rituximab, trade name: rituximab). Different from traditional chemotherapy drugs, rituximab is called "an artifact to accurately combat lymphoma". It is an anti-CD20 monoclonal antibody against malignant B lymphocytes, with good effect and little side effects, and it is a milestone in the treatment of lymphoma.

Since rituximab was listed in the United States in 1999, the 5-year survival rate of patients with diffuse large B-cell lymphoma has increased to 50%. Rituximab used to be a self-funded drug, which was expensive. Now it has been included in the scope of medical insurance reimbursement, which has enabled many cancer friends to enjoy the fruits of modern medical progress.

In addition, Kai-Fu Lee also tried many kinds.Natural therapyIn order to finally defeat cancer.

Keeping a good sleep is the most important thing. Staying up late for a long time may reduce the body’s immunity, and his lymphoma is a common cancer in the immune system. Therefore, after suffering from cancer, he made a schedule to protect his immunity. It is necessary to keep your mouth shut when disaster comes from your mouth. It is particularly important for cancer patients to keep their mouths shut, and maintaining good eating habits can better fight cancer. Kai-fu Lee suggested that everyone should eat more grains, beans, fruits and vegetables, and take a balanced intake. 3. Take your legs apart and exercise properly to inhibit cancer cells. Many studies have confirmed that exercise is beneficial to the rehabilitation of cancer patients and can reduce the risk of cancer recurrence after operation. However, it should be reminded that not all exercise is suitable for cancer patients, and it is suggested to use the principle of "not feeling tired". 4. Good attitude, get twice the result with half the effort When fighting cancer, it is very important to keep a good attitude, which has a great influence on cancer treatment.

Pancreatic cancer: steinman "tried medicine by himself", and the dendritic cell vaccine made him live for four and a half years!

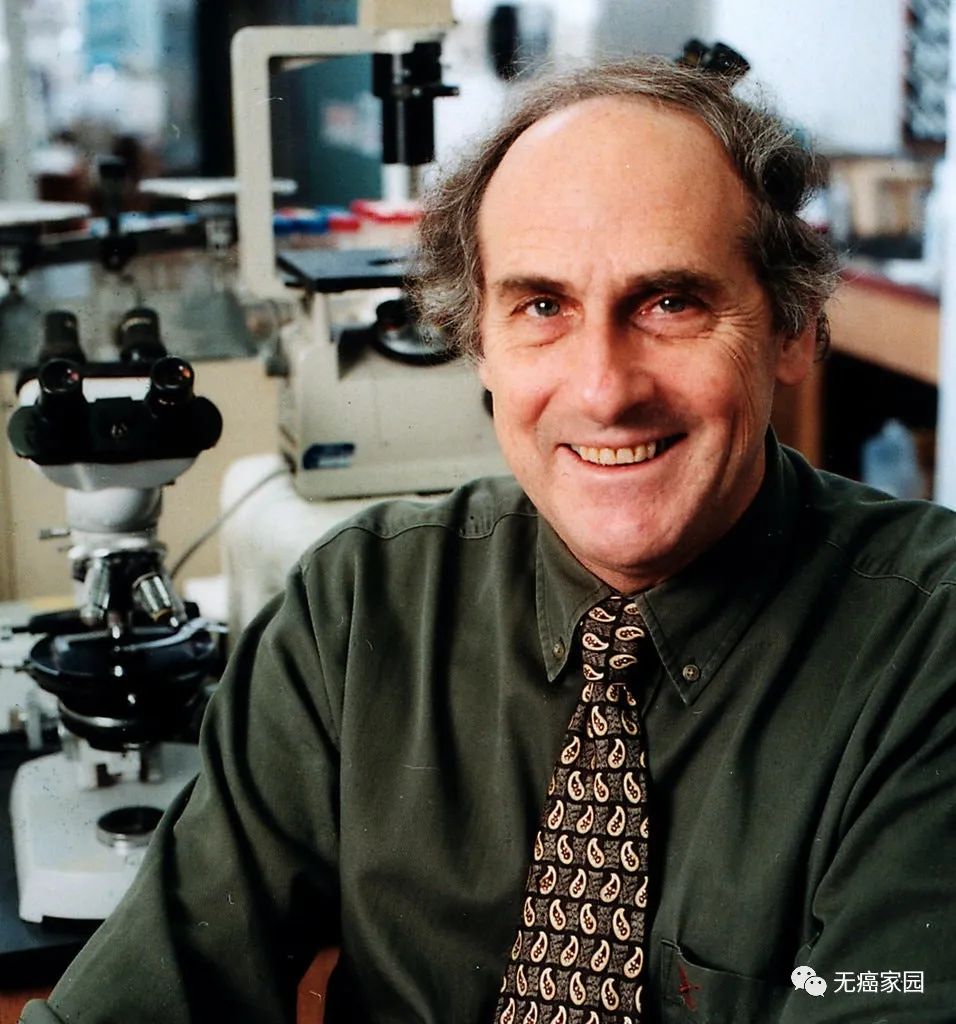

Speaking of vaccines, everyone is actually familiar with them, except for the common hepatitis B vaccine and influenza vaccine, and the Covid-19 vaccine that we have vaccinated up to now. In fact, cancer vaccine is also a form of immunotherapy, which can prevent cancer from developing or kill existing tumors by stimulating or restoring the human immune system. In the 21st century, the high incidence of cancer has attracted the attention of the global medical community. As a prominent tumor vaccine, dendritic cell vaccine has been a research hotspot in this field. When it comes to dendritic cell vaccine, we have to mention a legendary figure-ralph steinman, winner of the 2011 Nobel Prize in Physiology or Medicine.

ralph marvin steinman After the diagnosis of pancreatic cancer in 2007, steinman actively tried a therapeutic vaccine (DC vaccine) based on dendritic cells. With the help of this "cellular immunotherapy", his life was extended from the expected months to four and a half years. There is a rule in the Nobel Prize that they never give this prize to people who have passed away. However, ralph steinman broke this rule because he passed away quietly three days before receiving the call for winning the prize. Therefore, Staman is also called the most regrettable Nobel Prize winner.

0one Suffering from pancreatic cancer with a mortality rate of 95%, he devoted himself to the research of DC vaccine.

In 1973, steinman discovered dendritic cells in the spleen of mice, and put forward the concept of dendritic cells. In 2011, steinman shared the Nobel Prize in Physiology or Medicine with Jules Hoffman and Bruce Beutler for "discovering dendritic cells and their role in the acquired immune system".

Pancreatic cancer, which claimed steinman’s life, is one of the malignant tumors with the highest mortality rate at present. The mortality rate of this disease can reach 95% clinically, and it is very rare for patients who can survive for 5 years after being diagnosed with this disease (< 5%). There is no approved cancer vaccine for pancreatic cancer, and the prognosis is very poor. The survival time of advanced patients is weeks or months. The disease is usually treated with the cytotoxic drug gemcitabine. However, this treatment seems to be mainly used for palliative treatment of advanced pancreatic cancer, which can improve the quality of life and prolong the median survival time of 5 weeks. Most patients will soon develop resistance to this drug. Therefore, the indomitable Professor steinman tried to use dendritic cell vaccine to treat his pancreatic cancer. Dendritic cells are the main antigen presenting cells (APC) in the immune system. They process antigenic substances (for example, from invading bacteria and viruses, and from cancer cells) and present antigens on their surfaces to other types of immune cells, especially T cells. This leads to antigen-specific activation of T cells. Therefore, dendritic cells act as the main link between innate immune system and adaptive immune system.

02 After eight treatments, dendritic cell vaccine made him live for four and a half years!

Professor steinman tried eight experimental therapies, one at a time. For each of these treatments, he and his colleagues submitted a single-patient use agreement to the FDA and obtained the approval of the agency. In these treatments, there are three kinds of cancer vaccines, and steinman finally used the dendritic cell vaccine from his own tumor instead of the cell line. Patients with advanced pancreatic cancer usually have poor prognosis. The median survival time of locally advanced and metastatic pancreatic cancer (advanced pancreatic cancer accounts for more than 80% of individuals diagnosed with the disease) is about 10 months and 6 months respectively. For all stages of pancreatic cancer, the 1-year and 5-year relative survival rates were 25% and 6%, respectively. However, Dr. steinman’s life span has been extended from several months to four and a half years! Since then, the medical community has launched a craze for the research and development of dendritic cell vaccines, which has become a kind of immunotherapy with more research and development achievements in recent years. At present, the dendritic cell vaccines approved by the FDA and many clinical trials entering the third phase are worth looking forward to. Since 2010, exceptThe FDA approved the first dendritic cell vaccine Provenge(sipuleucel-T) for the treatment of refractory prostate cancer. Dendritic cell vaccine has achieved good results in all kinds of cancer. Such as brain tumor-DC VAX-L vaccine, melanoma-—TLPLDC vaccine, renal cancer-—ilixadencel vaccine, newly diagnosed glioblastoma-AV-GBM-1 vaccine, lung cancer-CCL 21-dendritic vaccine, breast cancer -Her2 pulsed dendritic cell vaccine, etc.Xiaobian will not go into details here.

Nasopharyngeal Carcinoma: After 33 proton treatments, Li Zongwei successfully returned to badminton.

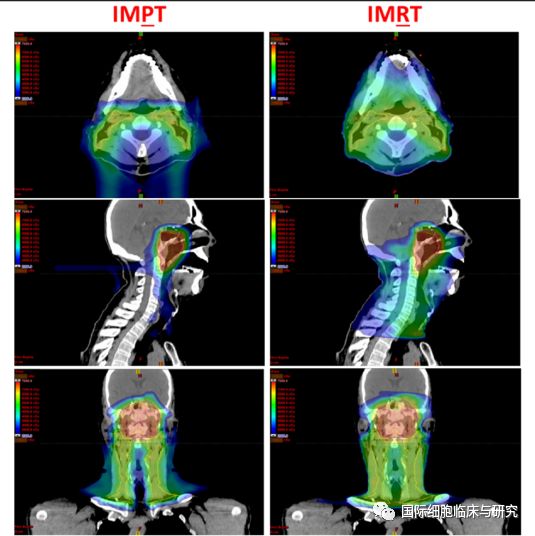

As the uncrowned king of badminton in the world, Li Zongwei, a famous Malaysian badminton player, has a brilliant career, with three runners-up in the Olympic Games, four runners-up in the World Championships, one runner-up in the soup cup and one silver medal in the men’s singles in the Asian Games. However, on July 25, 2018, he met another more powerful opponent-nasopharyngeal cancer. According to Malaysian media reports, Li Zongwei suddenly announced his withdrawal from the World Badminton Championships and the Asian Games badminton competition, and was later confirmed to have early nasopharyngeal carcinoma in September. However, Li Zongwei was not defeated by the disease. After 33 proton treatments of 25 minutes each time for more than two months, the doctor said that all the cancer cells in his body had been eliminated. In October of the same year, after he announced the success of anti-cancer, he said that he would return to badminton in December. Perhaps Li Zongwei is not a "winner" in badminton. Although he has won numerous titles, he has never won a world championship, including a slightly dismal record against Lin Dan. This time, however, in the face of this "competition" with the same disease, he finally won. This win will be the greatest capital of his life. In terms of treatment, it is difficult to perform radical surgery because of the special location and unclear boundary of nasopharyngeal carcinoma, the deep and narrow nasopharyngeal cavity, and many important blood vessels, cranial nerves and lymphoid tissues around it. But nasopharyngeal carcinoma is sensitive to radiotherapy, Therefore, radiotherapy is the main treatment for nasopharyngeal carcinoma, especially proton therapy. As the "king" of "precision radiotherapy", it can not only show its talents, but also effectively prevent the side effects of radiotherapy.

Proton therapy is a "qualitative leap" in tumor radiation!

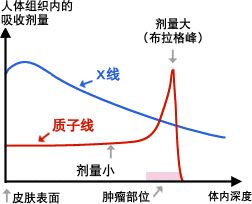

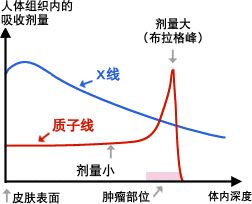

Proton therapy is to accelerate the nucleus of hydrogen atom (i.e. proton) which has lost electrons to about 70% of the speed of light by using cyclotron or synchrotron. After being accelerated by the accelerator, protons with positive charges become very penetrating ionizing radiation, which enters the human body at a very high speed, is guided by special-shaped equipment, and finally reaches the targeted tumor site. Because of its high speed, the chance of interaction with normal tissues or cells in the body is extremely low. When it reaches a specific part of the tumor, the speed suddenly decreases and stops, and the maximum energy is released, resulting in a "Bragg peak", which can kill cancer cells without causing damage to surrounding tissues and organs.

When tumors are directly adjacent to important organs or structures, such as spinal cord, optic nerve and heart, proton therapy can still effectively treat tumors while protecting the functions of these important organs or structures, which is impossible in conventional radiation therapy.

The high radiation dose is concentrated in the tumor site, and there is no/little dose in the surrounding normal tissues.

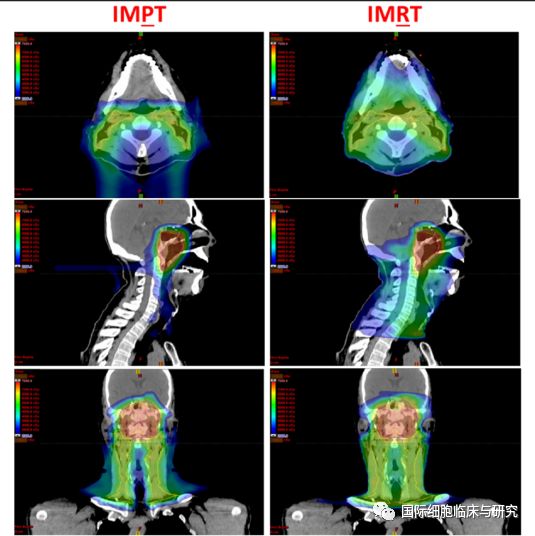

Legend: The radiation of Intensity Modulated Proton Therapy (IMPT) is mainly concentrated around the focus of nasopharyngeal carcinoma, with little or no influence on the surrounding normal tissues, while the radiation area of Intensity Modulated Radiotherapy (IMRT) is large, covering the focus and surrounding normal tissues.

Melanoma: "cured" after 4 months, immunotherapy made Carter the "longest-lived president"

In August 2015, former US President Carter was diagnosed with malignant melanoma, and liver metastasis and brain metastasis have occurred, so he is an out-and-out terminal patient. But just four months later, at an event in December, 91-year-old Carter announced that he had just confirmed after a general examination that the lesions in his body had disappeared.

It is understood that Carter used comprehensive therapy. First, the visible tumor was surgically removed, then the intracranial tumor was treated by radiotherapy, and finally the PD-1 drug Keytruda of Merck was used. After the brain cancer cells disappeared, Carter said that he would continue to use Keytruda for treatment. This incident made immunotherapy popular all over the world overnight. PD-1/PD-L1 and CTLA-4 pathways are crucial to the immune system’s ability to control cancer growth. These pathways are often called immune checkpoints. Many cancers will use these ways to escape the immune system. Specific antibodies to immune checkpoint inhibitors can block these pathways to deal with cancer. Once the immune system can find and deal with cancer, it can stop or slow down the development of cancer. Having said that, I have to mention the biggest difference between immunotherapy and traditional treatment, that is The trailing effect of immunotherapy, that is, patients who benefit from immunotherapy can continuously obtain stable results and bring long-term survival.

This article is original for a cancer-free home, and it needs authorization to reprint.