Joint venture travel companies have emerged. Why is it even less likely that FAW Dongfeng Changan will merge?

With the promotion of cooperation among the three parties in various fields and the concrete implementation of projects, it is not important whether they merge or not.

If we talk about the rumors in the car industry, the first one is the merger of FAW, Dongfeng and Changan. As soon as there is trouble, there will be a wave of merger rumors.

No, the three joint venture travel companies have made the latest progress, and it is estimated that a new wave of merger rumors will come again.

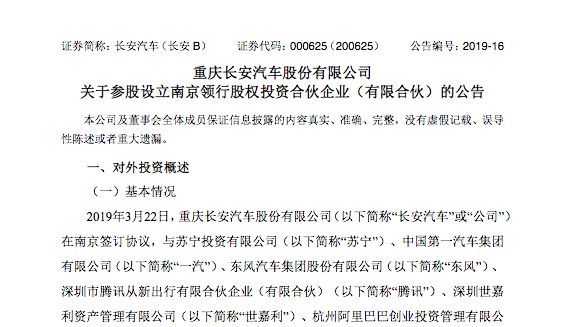

On March 22, Changan Automobile (000625) announced at noon that it had jointly invested with Suning Investment Co., Ltd., China FAW Group Co., Ltd. and Dongfeng Motor (600006) Group Co., Ltd. in Nanjing to establish the equity investment partnership (limited partnership) of Nanjing Leading Bank, with a total share of 9.76 billion yuan.

Other investors include Shenzhen Tencent New Travel Limited Partnership (Limited Partnership), Hangzhou Alibaba Venture Capital Management Co., Ltd., Shenzhen Shijiali Asset Management Co., Ltd., Wuxi Feiye Investment Co., Ltd., Xianning Rongxun Smart Travel Industry Investment Fund (Limited Partnership), Nanjing Hengchuang Yunzhi Network Technology Co., Ltd. and Nanjing Leading Equity Investment Management Co., Ltd.

Among the many funders, Suning contributed 1.7 billion yuan, FAW, Dongfeng and Changan each contributed 1.6 billion yuan, and Tencent and Ali jointly contributed 2.25 billion yuan with three other funders, but their specific contributions are unknown.

Today, Dongfeng Motor also issued a similar announcement, announcing the news with pleasure.

The joint venture travel company will invest in the shared travel industry with new energy vehicles as the main part. The project aims at creating a networked and shared "new ecology of smart travel" and "strives to become the most reliable travel service enterprise in China".

The partnership travel company will be managed by a qualified fund management company entrusted by Nanjing Leading Equity Investment Management Co., Ltd.. In addition to providing abundant resource support, investors in the project will also introduce socialized mature talents and mature management experience in core positions to improve the level of operation and management.

In the future, this travel company will be a completely market-oriented operation mode.

Dongfeng revealed in the announcement that the joint venture company will integrate online transportation platforms, offline car sharing and mobile operations, asset management companies and big data centers, thus connecting consumers and automakers.

If the project lands, it will not only actively promote the traditional vehicle business of the three car companies, but also bring about sales increment, further improve the enterprise ecosystem and accelerate the pace of transformation.

After the announcement, the daily limit of Changan Automobile and Dongfeng Motor increased, while the share prices of FAW Car (000800) and faw xiali rose to varying degrees.

Tripartite cooperation has landed in the field of travel

In July 2018, FAW, Dongfeng and Chang ‘an signed a mobile travel intention agreement and decided to form a joint venture T3 travel service company. This time, the three parties joined forces with many external partners to jointly set up the equity investment partnership of Nanjing Leading Bank, which is the landing of T3 travel project.

The rumors of the merger of FAW, Dongfeng and Changan have a long history. At first, it should start with the change of defense of the leaders of the three groups, and then there is partial cooperation between enterprises. For example, in February 2017, Dongfeng and FAW signed a strategic framework agreement, and the two sides planned to jointly build a forward-looking common technology innovation center.

Soon, the three groups began all-round strategic cooperation.

On December 1, 2017, FAW, Dongfeng and Changan signed a strategic cooperation framework agreement in Wuhan, which will cooperate in four major areas: forward-looking common technology innovation, automobile full value chain operation, joint "going out" and new business models.

Since then, the three parties have set up 12 project teams to carry out concrete project cooperation in macro-policy and industrial development research, vehicle platform, powertrain, new energy, intelligence, new business model, basic R&D and system construction, parts procurement, warehousing and logistics, manufacturing, international layout and capital cooperation.

Since entering 2018, various cooperation has begun to land.

On March 9, 2018, the three parties held a signing ceremony for the promotion meeting and project approval of cooperation projects in the manufacturing field in Wuhan.

On July 6, 2018, the three parties signed a T3 logistics strategic cooperation agreement in Wuhan to establish a "1+1+3" logistics enterprise strategic cooperation innovation model.

On July 13, 2018, the three parties signed a mobile travel intention agreement and decided to form a joint venture T3 travel service company.

On December 21, 2018, the three parties signed an intention agreement on joint venture and cooperation of T3 Technology Platform Company, which will focus on the research and development of the core systems, modules and platforms of the next generation of automobiles.

Until today, the equity investment partnership of Nanjing Leading Bank has surfaced, and the cooperation among the three parties in the field of travel has been substantially promoted.

Among the shareholders of the partnership travel company, in addition to the three central enterprises, there are also giants such as Suning, Tencent and Ali. Changan Automobile said in the announcement, "This project can make full use of the brand influence of all investors, attract policies and resources of all investors in technology, capital and flow, and create competitive advantages."

As you can imagine, the travel company has vehicle resources, channel resources, financial resources, and the background of central enterprises as an endorsement. Coupled with the brand influence of all parties, it is absolutely famous and rooted in Miao Hong. Therefore, the most nervous thing today should be Didi.

However, due to frequent security incidents and stricter industry supervision, the current shared travel industry is at a low point. In addition, car companies basically have their own travel projects or are deeply bound with external travel platforms, and the industry is in a state of vassal separation. As a latecomer, it remains to be seen whether Nanjing Leading Partnership can win the market.

Traditional merger is being abandoned.

The Medium-and Long-Term Development Plan of Automobile Industry jointly issued by the Ministry of Industry and Information Technology, the National Development and Reform Commission and the Ministry of Science and Technology in 2017 is a programmatic document for China to respond to the changes in the automobile industry and promote the strategy of strengthening the automobile country.

It is clearly stated in the Plan that "cooperation modes such as capital, technology, production capacity and brand within the automobile industry chain and across industries should be encouraged, and advantageous enterprises should be supported to form strong alliances through mutual shareholding and strategic alliances, so as to continuously improve industrial concentration" and "the reform of mixed ownership should be steadily promoted, and cooperation between state-owned enterprises and other non-public enterprises in production capacity, channels, investment and financing should be realized through market-oriented means and various modes".

This time, FAW, Dongfeng and Changan joined hands with cross-border partners to set up a travel company in the form of a partnership, which is an active exploration and innovation for the reform of mixed ownership and conforms to the policy orientation of the Medium and Long-term Development Plan for the Automobile Industry.

Auto business review believes that compared with the simple administrative means of enterprise merger, the more commercial operation mode and diversified equity management structure of Nanjing Leading Partnership are obviously more in line with the country’s current positioning of central enterprises.

With the promotion of cooperation between FAW, Dongfeng and Changan in various fields and the concrete landing of projects, the business is deeply integrated, and after the cooperation is on the right track, it is not important whether they merge or not.

The establishment of the partnership travel company indicates that the possibility of future merger of the three car companies is getting smaller and smaller.

In fact, there has been a trend around the world: traditional corporate mergers are being replaced by various ecosystems, alliances and cooperation. Cooperation is more important than ever for car companies, but the way they form alliances with each other is more and more inclined to date than marriage. (See "Why the new automobile industry alliance prefers" dating "to" marriage ")

Travel as a Service (TAAS) in the automotive industry? ? Under the general trend, the greater competition in the future is not between car companies, but between travel platforms. BMW and Daimler are merging their DriveNow and Car2Go car sharing businesses. Under the new competition mode, this horizontal alliance between car companies is obviously more important.

The same is true for FAW, Dongfeng and Changan to form a joint venture travel company. Moreover, the introduction of external multi-party partners can not only reduce investment costs, but also share possible risks.

In the process of traditional car companies transforming into mobile travel companies, the three car companies have joined forces with head companies in the Internet, finance, retail and other industries to enter the shared travel market, which is undoubtedly the fastest, lowest cost and least risk transformation mode.

This article first appeared on WeChat WeChat official account: auto business review. The content of the article belongs to the author’s personal opinion and does not represent Hexun.com’s position. Investors should operate accordingly, at their own risk.