Brief comment on air conditioning data in December of 18: the growth rate of domestic sales turned positive year-on-year, hitting a record high again in the whole year.

Industry online disclosure of air conditioning production and sales data in December of 18 years

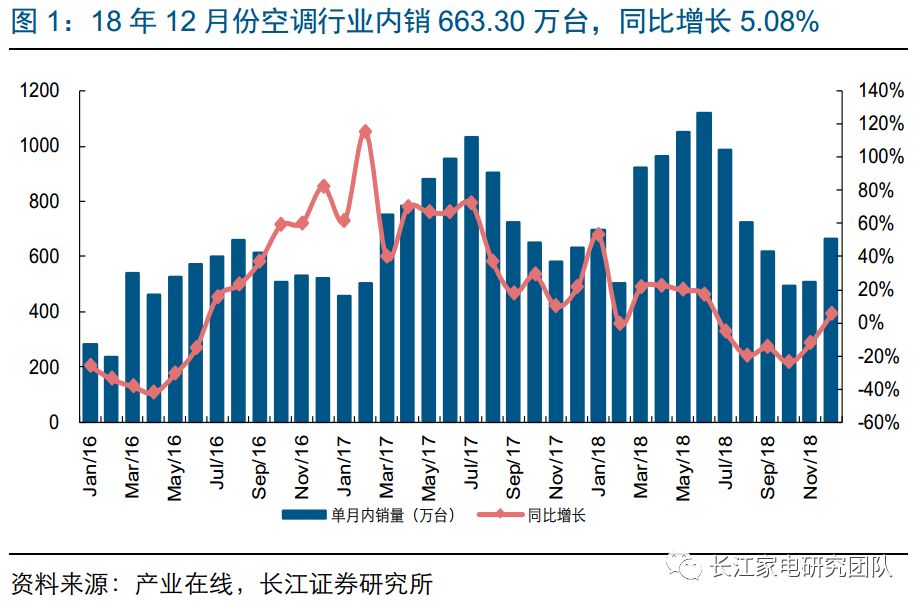

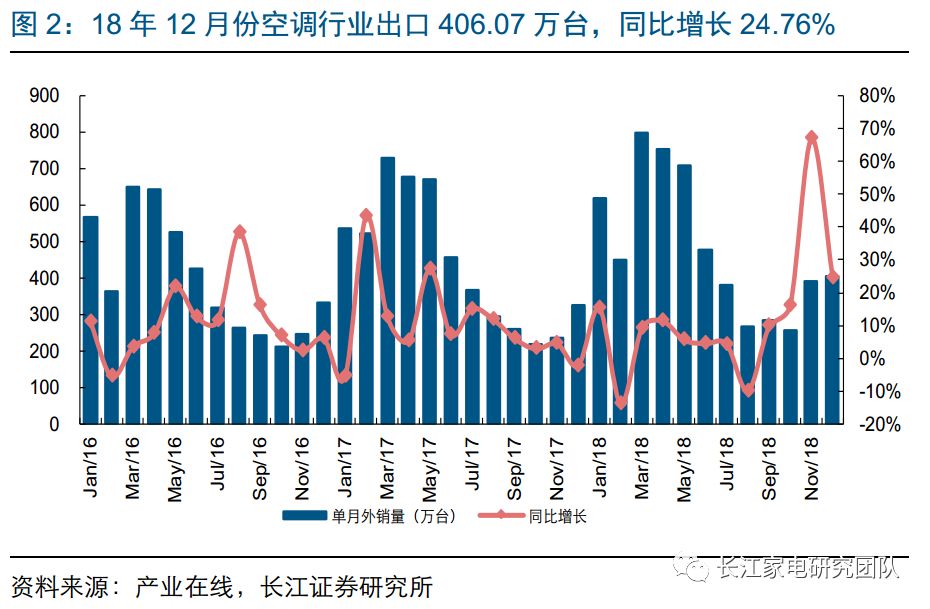

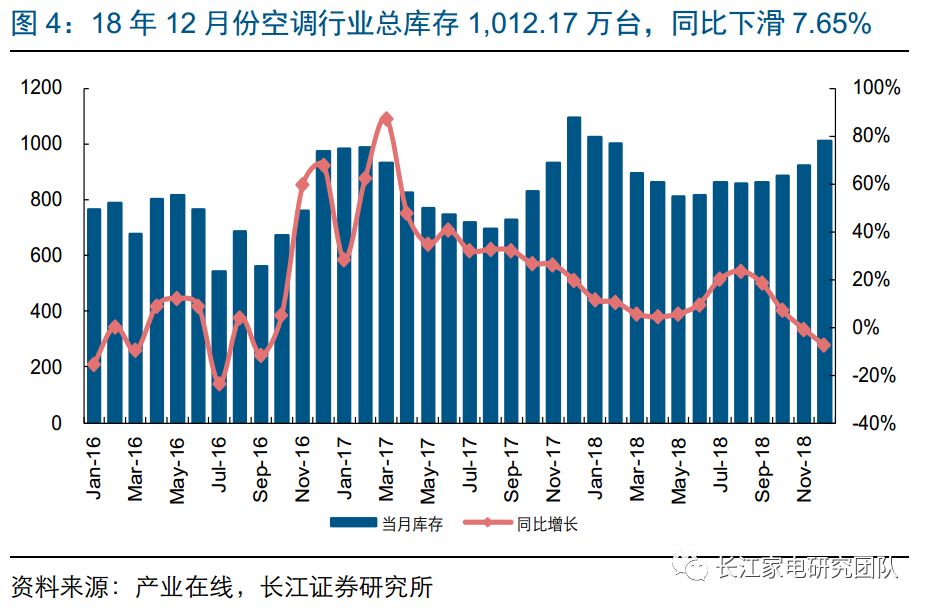

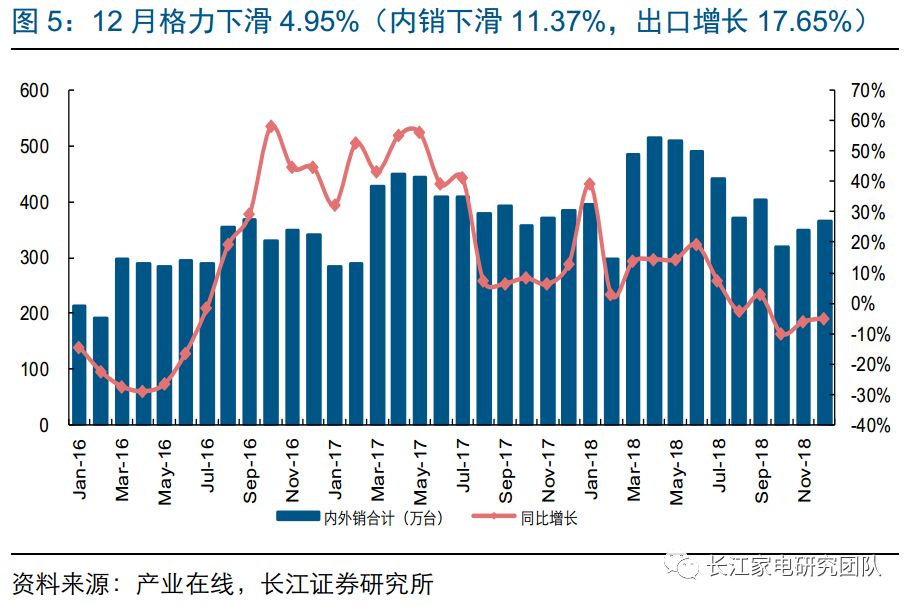

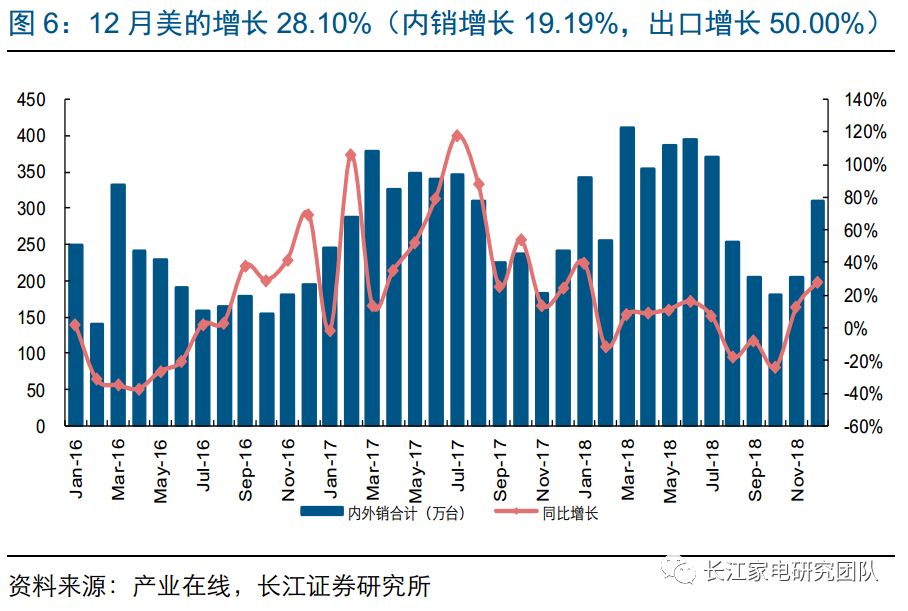

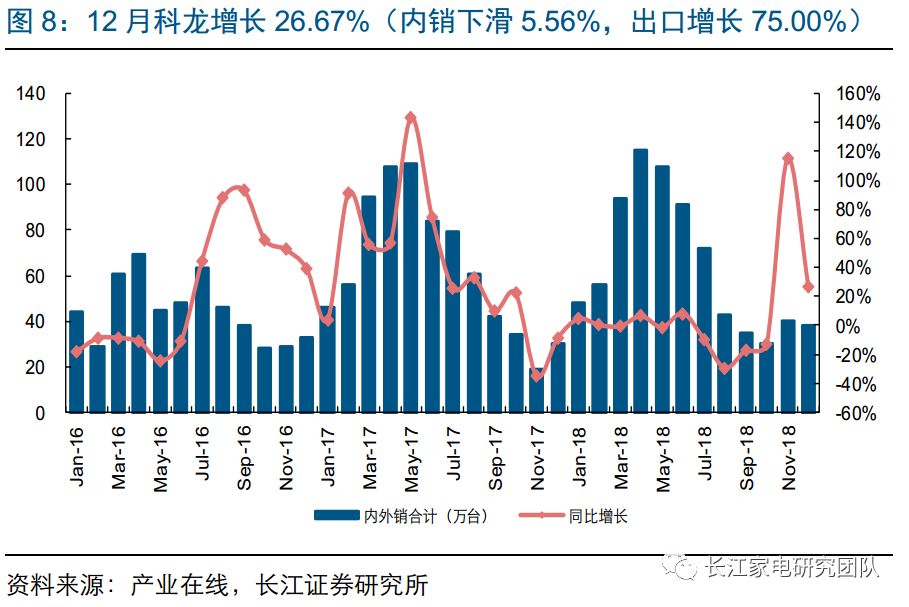

Production and sales data in December, 18: The total output in that month was 11,570,000 units, up by 3.17% year-on-year, and the total sales volume was 10,693,700 units, up by 11.78% year-on-year, of which 6,633,000 units were sold domestically, up by 5.08% year-on-year, and 4,060,700 units were exported, up by 24.76% year-on-year, and the total At the level of listed companies, Gree fell by 4.95% (domestic sales fell by 11.37% and exports increased by 17.65%); Midea increased by 28.10% (domestic sales increased by 19.19% and exports increased by 50.00%); Haier fell by 15.03% (domestic sales fell by 15.52% and exports fell by 13.51%);It increased by 26.67% (domestic sales decreased by 5.56% and exports increased by 75.00%).

Cumulative production and sales data for the whole year of 18 years: the cumulative total output was 149,850,500 units, up 4.43% year-on-year, and the total sales volume was 150,690,900 units, up 6.34% year-on-year, of which 92,808,500 units were sold domestically, up 4.57% year-on-year, and 57,882,400 units were exported, up 9.32% year-on-year. At the level of listed companies, Gree increased by 7.33% (domestic sales increased by 3.39% and exports increased by 18.79%); The cumulative growth of Midea was 5.69% (domestic sales increased by 2.96% and exports increased by 9.35%); Haier’s cumulative growth was 13.13% (domestic sales increased by 7.47% and exports increased by 31.20%); Hisense’s household appliances increased by 5.65% (domestic sales increased by 0.04% and exports increased by 15.36%).

The growth rate of domestic sales turned positive year-on-year, and the export performance remained excellent.

In the month, the domestic sales of the industry achieved single-digit growth, which was the first positive growth in a single month since the second half of 18 years; Both the third-party retail monitoring data and the installation card data of leading enterprises show that the demand performance of air-conditioning terminals is still relatively dull in December. We judge that the main reason for the rebound in domestic sales in the industry is that on the one hand, the Spring Festival this year is earlier than last year, and the demand for stocking by channel dealers is released in advance. On the other hand, the raw material prices of copper and steel have declined recently. Under this background, it is reasonable for enterprises to increase production scheduling to lock in costs. In addition, it is expected that air-conditioning enterprises will sprint the annual target at the end of the year to drive sales. On the export side, the export growth rate of the industry remained at a high level in the month, mainly because the expected increase in subsequent tariffs led to the early release of some export orders. From the perspective of the whole year, the total domestic sales of the air-conditioning industry in 18 years exceeded 90 million units for the first time, hitting a record high on the basis of the high base in 17 years, and the performance was better than the market expectation at the beginning of 18 years; The export growth rate was slightly faster than domestic sales, driven by the bright performance in the fourth quarter.

The performance of manufacturers is divided, and the trend of share concentration remains the same.

The domestic sales performance of air-conditioning enterprises in the month was different, among which Midea increased by nearly 20% year-on-year, which is expected to mainly benefit from the fact that the company’s channel inventory under the "T+3" mode was significantly lower than the industry average, and the company’s terminal installation card maintained a single-digit growth in the fourth quarter, which also had good support for the delivery end; In addition, the sales volume of Oaks in the month increased by 122.22% year-on-year under the background of low base, and its performance was more eye-catching; However, Gree’s domestic shipments continued to decline in the month, and the relatively high channel inventory may have a certain impact. However, the company’s recently disclosed 18-year performance forecast shows that the company’s revenue still increased by more than 30% in the fourth quarter, and the actual shipment growth rate is expected to be significantly better than that of the third-party data statistics. Generally speaking, although the growth rate of domestic sales of leading air-conditioning enterprises has slowed down in the past 18 years, it still maintains a relatively steady growth, and the domestic sales of CR4 in the industry increased by 1.70pct to 80.01% year-on-year, among which the increase of Oaks share was the most obvious; Considering the historical experience of leading enterprises in the pressure-bearing stage of the industry boom to seize the market share of long-tailed enterprises and the relatively dull market expectation of air-conditioning domestic sales in 19 years, the market share of leading enterprises in the follow-up industry is expected to increase steadily and drive the domestic sales performance to exceed market expectations.

There is no need to worry too much about channel inventory, and domestic sales have been "low before and high after 19 years"

At present, the market is worried about the high level of air-conditioning channels or the suppression of domestic sales in subsequent industries, but we believe that although the overall channel inventory level has improved in 18 years, it is still within a reasonable range; According to the monitoring data of third-party retailers such as Aowei and Zhongyikang, and the statistical data of installation cards of leading manufacturers, the retail volume of omni-channel terminals of air conditioners has achieved a small single-digit growth year-on-year in 18 years, which basically matches the growth rate of domestic shipments in the whole year. Considering that the installation card base in 17 years should be slightly higher than the shipment end, it is estimated that the industry channel inventory will increase in 18 years, but the range is limited. Combined with the financial indicators of leading enterprises and channel research, the current pressure of channel dealers’ capital turnover is also significantly lower than the high point of channel inventory in the last round in 14-15. Considering the steady increase in rural areas and third-and fourth-tier cities, and the continuous release of the demand for the renewal of the first-and second-tier markets, the overall demand of the industry is still expected to maintain steady growth in 19 years, and if the follow-up subsidy policy is introduced as scheduled, the driving effect on the demand of the industry is also worth looking forward to. Driven by this, there is no need to worry too much about the domestic sales performance of air conditioners in 19 years, and the growth rate will be low before and high after being disturbed by the base.

The value of leading configuration is highlighted, maintaining the industry’s "optimistic" rating.

In the same month, driven by factors such as channel dealers stocking up in advance and air-conditioning enterprises sprinting for the whole year, the growth rate of domestic sales in the industry turned positive year-on-year. In 18 years, the total annual sales exceeded 90 million units, reaching a record high and exceeding the market expectations at the beginning of the year. In the past 19 years, based on the steady release of industry demand and the limited improvement of channel inventory, there is no need to worry too much about the domestic sales performance of air conditioners, and the growth rate is likely to be low before and then high. Considering that the industry boom is often a good opportunity for leading enterprises to seize market share, the profitability is expected to continue to improve under the background of superimposed healthy competition pattern and gradual correction of raw material prices, and the deterministic advantage of white electricity leading enterprises’ performance will continue to be highlighted; After the previous stock price correction, the current valuation of white power blue chip is still at a relatively low level. With the recent increase in foreign capital allocation and the expected continuous strengthening of subsidy policy, the restoration of its valuation center is worth looking forward to, and the value of stable allocation continues to be highlighted; To sum up, maintain the industry’s "optimistic" rating, continue to recommend that the performance growth rate is determined, the valuation safety margin is high, and it has a strong comparative advantage on a global scale.、andAt the same time, we are still optimistic about Hisense home appliances, a central air-conditioning concept stock that benefits from the high growth of the industry.

Risk warning: the industry demand is less than expected; The price of raw materials has risen sharply; Exchange rate fluctuations have increased.

Securities research report: Brief comment on air conditioning data in December of 18: the growth rate of domestic sales turned positive year-on-year, hitting a record high again in the whole year.

Release date: January 20, 2019

Research report rating: maintain the "optimistic" rating.

Report issuing agency:research institute

Participant information:

Xu Chun SACNo.: S0490513070006 E-mail: xuchun@cjsc.com.cn

Guan Quansen SACNo.: S0490516070002 Email: guanqs@cjsc.com.cn

Sun Shan SACNo.: S0490517020002 E-mail: sunshan@cjsc.com.cn

He Bendong E-mail: hebd@cjsc.com.cn

Cui Tiantian E-mail: cuitt@cjsc.com.cn

Zhou Zhen E-mail: zhouzhen1@cjsc.com.cn

A brief review report on the links of recent key research reports

⊙ Midea Group | Profitability continued to improve, and its performance met expectations.

⊙ How to interpret the share price of home appliance sector in the last round of subsidy cycle?

How to treat the phenomenon of consumption classification in household appliances industry?

Deep research on the real estate impact of home appliance industry: the cycle is a preface.

⊙ The snow is abundant, and the clouds are bright.

⊙ Understanding Beauty and past lives of Little Swan

Brief comment on air conditioning data in November: domestic demand is steady, and the growth rate of export orders is eye-catching

Re-discussion on "scissors difference" effect under the background of cost improvement

In 2018, what happened to the three leading companies?

⊙ What new categories of home appliances are worth looking forward to?

Enlightenment from SEB

FromOn the growth motivation of small household appliances industry

⊙ Has the kitchen appliance industry seen the bottom?

⊙ An overview of the business performance of home appliance industry in the third quarter

⊙ Gree Electric | Rational Interpretation of Third Quarterly Report Exceeding Expectations

⊙ Midea Group | Pearl is "dusty" and does not reduce its lustre.

⊙ Qingdao Haier | Not afraid of the pressure of the economy, showing the true colors of leading enterprises.

⊙ Hisense Household Appliances | Short-term operation is under pressure, but the cash flow performance is bright.

⊙?? | The "defect" of the short-term boom does not hide the "Yu" of the company.

Depth report

⊙ Keep the clouds open and see the clouds bright | 2019 annual investment strategy of home appliance industry

Family serviceIn-depth study of the industry: a journey of a thousand miles begins with a single step.

⊙ hurricane and rain, marching forward | Summary of financial report in the third quarter of 2018

⊙ Huacai has resurfaced and is sailing | Re-read Vantage shares in leading series.

⊙ Looking forward to the present and the future, the dragon continues to write brilliant new articles | Re-reading Qingdao Haier in the leading series

Fifty years of hardships, but now it is in its prime | Re-read the beauty group of leading series

⊙ Multi-dimensional Analysis, Re-discussion on Gree’s Investment Value | Re-reading Gree Electric of Leading Series

Central air conditioning: the trend of household achievement, and the big cycle has just begun.

When we buy consumer stocks, what are we buying?

What is the achievement??

Rating description and statement

Rating description

Industry rating: the rise and fall of the industry stock index in the 12 months after the report is released is based on the rise and fall of the relevant securities market representative index in the same period. The rating criteria for investment suggestions are: optimistic: the relative performance is better than the relevant securities market representative index in the same period; Neutral: the relative performance is the same as the representative index of the relevant securities market in the same period; Bearish: The relative performance is weaker than the representative index of relevant securities markets in the same period.

Company rating: within 12 months after the release of the report, the company’s rise and fall is based on the rise and fall of the representative index of the relevant securities market in the same period. The rating criteria for investment suggestions are: buy: the increase of the representative index of the relevant securities market in the same period is greater than 10%; Overweight: Compared with the same period, the representative index of relevant securities markets increased by 5% ~ 10%; Neutral: Compared with the relevant securities market representative index in the same period, the increase is between-5% and 5%; Reduction: the increase of the representative index of the relevant securities market is less than-5% compared with the same period; No investment rating: we can’t give a clear investment rating because we can’t get the necessary information, or the company is faced with major uncertain events with unpredictable results, or for other reasons.

Description of relevant securities market representative index: A-share market is dominated byAs a benchmark; The new third board market is based on the three-board index (for the agreed transfer target) or the three-board market-making index (for the market-making transfer target); The Hong Kong market is based on the Hang Seng Index.

Important statement

Changjiang securities Co., Ltd. has the qualification of securities investment consulting business, and the license number of securities business is 10060000. This report is only issued in Chinese mainland, and is only used by customers of changjiang securities Co., Ltd. (hereinafter referred to as the Company). The company will not regard the recipient as a customer because he receives this report. The information in this report comes from public sources, and the company does not guarantee the accuracy and completeness of this information, nor does it guarantee that the information and suggestions contained therein will not change. Our company has made every effort to report objectively and fairly, but the opinions, conclusions and suggestions in this paper are for reference only, and do not include the author’s definitive judgment on the fluctuation of securities prices or market trends. The information or opinions in the report do not constitute the bid or price of the securities, and any investment decision made by investors based on it has nothing to do with the company and the author.

The information, opinions and speculations contained in this report only reflect the judgment of the Company on the date of publication of this report. The price, value and investment income of the securities or investment targets mentioned in this report may go up or down, and the past performance should not be used as the basis for future performance; At different times, the Company may issue other reports that are inconsistent with the information contained in this report and have different conclusions; The different viewpoints, opinions and analysis methods of researchers reflected in this report do not represent the position of our company or other affiliated institutions; We do not guarantee that the information contained in this report will be kept up to date. At the same time, the information contained in this report can be modified without notice, and investors should pay attention to the corresponding updates or modifications. The Company and the author, within their own knowledge, have no conflict of interest with the securities evaluated or recommended in this report, which are required to be disclosed by laws and regulations or take restrictive or silent measures.

The copyright of this report is only owned by our company. Without written permission, no organization or individual may copy, reproduce and publish it in any form. If quoted, the source must be indicated as changjiang securities Institute, and this report shall not be quoted, abridged or modified against its original intention. If this securities research report or abstract is published or forwarded, the publisher and date of publication of this report shall be indicated, and the risks of using the securities research report shall be indicated. If this report is published or forwarded without authorization, the company will reserve the right to pursue legal responsibility against it.

Legal statement

This subscription number is not the official subscription platform of changjiang securities Research Institute. Please refer to the subscription number of "Changjiang Research" for relevant opinions or information. This subscription number is only for professional investors in changjiang securities customers. According to the Measures for the Administration of Suitability of Securities and Futures Investors, if you are not a professional investor in changjiang securities customers, please do not subscribe to or reprint the information in this subscription number in order to ensure service quality and control investment risks. Changjiang Research does not regard subscribers as customers of changjiang securities because of any subscription to WeChat official account.

This subscription number aims to communicate research information and share research results. The information pushed is "investment information reference service" rather than specific "investment decision service". The content of this subscription number is only a summary of the report. For details, please refer to the full report published by Changjiang Research. The push information of this subscription number is only valid on the day when the complete report is released. If the push information is no longer accurate or invalid due to the update of relevant factors after the release, this subscription number does not undertake the obligation to update the push information or notify it separately. Please refer to the official public release report of Changjiang Research for subsequent update information.

The market is risky and investment needs to be cautious. Recipients of this subscription number should carefully read the attached statements, information disclosure items and relevant risk warnings, fully understand the key assumptions contained in the report, and accurately understand the meaning of investment rating. In any case, the opinions expressed in the information in this subscription number do not constitute investment advice to anyone. Subscribers should not rely solely on the information in this subscription number to replace their independent judgment, but should make their own investment decisions and bear all investment risks.

Disclaimer: All the contents provided by the media are from the media, and the copyright belongs to the original author. Please contact the original author and get permission to reprint. The views of the article only represent the author himself and do not represent Sina’s position. If the content involves investment advice, it is for reference only and not as an investment basis. Investment is risky, so be cautious when entering the market.