China Unionpay Quick Pass, which is used by 400 million people, is easy to use.

The credit card and savings card in hand can be put together to fight the landlord. However, nowadays, whether we surf the internet for passionate shopping, transfer money online, pay back credit cards, swipe the code by subway or scan the code in convenience stores, we basically rely on mobile phones. After all, mobile phones are the cyber ontology of urban workers. Every urban migrant worker who holds a large number of credit cards has suffered from insomnia, dreaminess and hair loss for a few days at the end of the month, because credit card repayment bills are pouring in, but you can never remember the repayment time. In order to reduce the burden on the life of urban workers, many mobile payment platforms have emerged in recent years, but the use process is still full of twists and turns. For example, the repayment fee of credit cards is getting more and more expensive, the bank card number needs to be photographed or manually entered, the management steps of multiple bank cards are numerous, and various preferential activities are scattered everywhere. I don’t know whether it is convenient for the life of urban workers or worse.

Adhering to the core idea of bold doubt and careful verification, some media recently experienced the "unified mobile payment app for banking"-China Unionpay Quick Pass. After a short operation, it was found that it really provided a lot of convenience for our daily life in terms of bank card management and consumer payment. We have three core requirements for a mobile payment software! Safe, convenient and preferential. Let’s start with the most important security. China Unionpay Quick Pass APP is a mobile payment product jointly built by China UnionPay, various commercial banks and industrial parties, with 430 million users. China Unionpay Quick Pass APP, which has the status of the national payment team, has a very high security guarantee for user accounts. Secondly, it is the most troublesome convenience. China Unionpay Quick Pass APP systematically integrates the product functions according to the pain points of users in mobile payment. In the process of evaluation and use, we found that it has the following special advantages: 1. One-click card binding, cross-bank and cross-category management of 30 cards; 2. Credit card repayment of 0 handling fee, support for automatic check of hundreds of bank bills; 3. Cross-bank transfer of 0 handling fee, no need to withdraw cash when arriving at the card in real time; 4. Check the balance of multiple savings cards with one click, and the assets are clear at a glance.

One APP can handle all bank cards.

What is the first step to access the fast cyber mobile life? Of course, it is bound to a bank card. At present, the most common way to bind the card is to manually enter the card number or take a photo of the bank card for system identification, but both of them need to be stuck with you. If there is an emergency, such as the money in the binding card is not enough, it is often difficult to add a new card to the mobile wallet. People in other places can’t let friends break my door, rummage through everything to find out the bank card and send it to me by express. China Unionpay Quick Pass APP has added a more convenient one-button card binding function to the first two card binding methods. Even if you don’t have a bank card at hand, it doesn’t matter. You can bind the card directly through your identity information. Enter the "one-click card binding" interface, click the bank card opening bank, and after authorization, you can directly see my bank card, and you can complete the card binding through SMS verification of the reserved mobile phone number of the bank. After the binding is successful, our cards are properly arranged in the digital card bag.

At present, China Unionpay Quick Pass APP supports one-click card binding operation of more than 100 banks, and an account can manage 30 cards across banks and categories.

Credit card repayment fee is 0, which supports automatic checking of hundreds of bank bills.

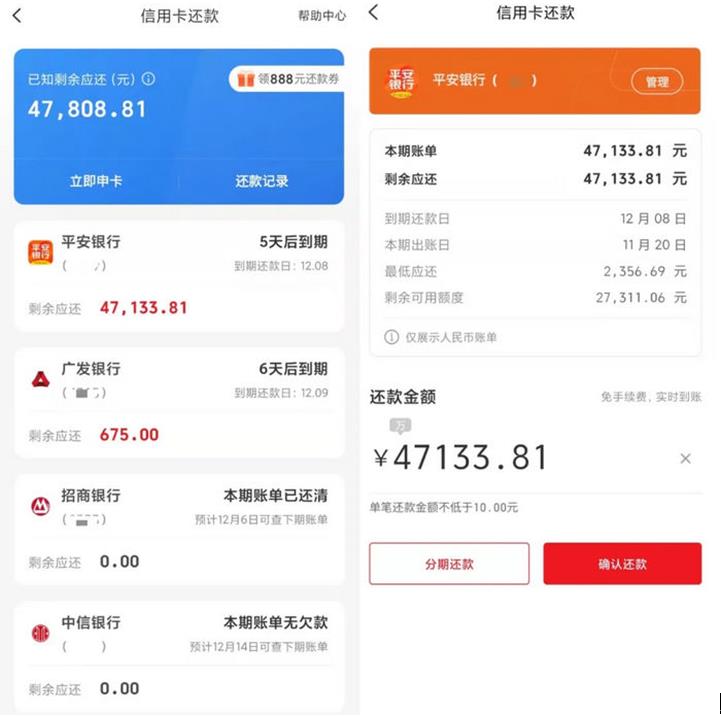

Every month, I have to charge a handling fee when I pay back my credit card on the third-party mobile payment platform. The moment I click the repayment button, it makes my poor wallet worse. After the credit card is bound to China Unionpay Quick Pass, the detailed repayment time and amount of the credit card held can be seen at a glance, and it also supports the automatic inquiry of bills of hundreds of banks to remind the repayment date, so as to avoid the influence of insufficient repayment on credit investigation. Once the credit card is overdue, it is really a very troublesome thing. My precious and sparse hair is finally only used for work. Touching people! China Unionpay Quick Pass paid back the credit card with a handling fee of 0, whether it was 2,000 yuan or 10,000 yuan, it was 0! Handling fee! There are even rare repayment concessions through third-party channels. For example, a newcomer can get a 10 yuan repayment coupon directly by tying a card.

Recently, on the WeChat applet of UnionPay Welfare Society, you can also withdraw credit card repayment vouchers of up to 4,999 yuan, which can be drawn once a day! What can I say? What if I were that koi fish?

There is 0 handling fee for inter-bank transfer, and there is no need to withdraw cash when you arrive at the card in real time.

In addition to credit card repayment, another pain is bank card transfer. For example, I pay the rent to my landlord every quarter, and I use the card of China Merchants Bank, and the landlord asks me to transfer the money to his card of China Bank. Every time I transfer a fee, I feel that I have lost a huge sum of money. Experiencing China Unionpay Quick Pass APP, I was pleasantly surprised to find that using it to transfer money across banks is actually zero handling fee, and we can still leave a lot of money a year without a handling fee. Moreover, in the transfer interface, you will be automatically prompted for the balance of your bank card to avoid the embarrassing situation that there is not enough money in the card.

In addition, China Unionpay Quick Pass APP can realize the real-time receipt of funds, and there is no time lag, so it will be more reassuring to use it when you need to allocate funds quickly.

China Unionpay Quick Pass has the function of making an appointment for transfer, and you can customize the frequency, date, termination time and remark name of regular transfer, so as to make regular transfer planning. Appointment transfer is very practical for some fixed expenses, such as paying rent, car loan, mortgage loan, etc., and you are not afraid to forget the overdue.

Migrant workers always have their own little pleasures in life. For example, tea time and his colleagues buy a milk tea together, and go for a drink and watch a performance or play a script on weekends. When organizing personnel to collect money after AA, China Unionpay Quick Pass collection code is adopted, and everyone transfers money to the card in real time, so it is convenient and quick to collect funds without withdrawing cash.

Query the balance of multiple savings cards with one click.

I don’t know if you have this experience. When you use some payment software to transfer money or pay, you suddenly forget how much money you have in your bank card. At this time, you have to try several times to transfer money to a card. Although each bank’s APP supports checking the balance of its own bank card, the next pile of bank apps also takes up a lot of mobile phone space, and the frequency of use is not so high. China Unionpay Quick Pass’s more convenient function is that he can check his balance on each bank card with one click after tying the card. You can see all your cards on the "Card Management" page, and then click the corresponding bank card to check the balance in this card. In addition, on this page, you can also view the balance of each card and various information by swiping left and right.

In this way, centralized management is very convenient and clear at a glance, which is very suitable for people like me who have multiple bank cards and credit cards. You only need one China Unionpay Quick Pass APP to manage bank cards digitally anytime, anywhere, and you don’t have to jump repeatedly on each APP.

Small coup to save money by spending more concessions.

In addition to credit card and bank card management, China Unionpay Quick Pass APP also covers a wide range of consumption scenarios. After testing, we found that many merchants can choose to use China Unionpay Quick Pass and Taobao when they scan the code for payment on WeChat, and they can also use it when they pay for shopping. In addition, I would like to talk about three functions of China Unionpay Quick Pass, which are closely related to daily life-public transportation, living payment and electronic medical insurance. There are "trips" in the four diamond positions where China Unionpay Quick Pass opens the interface, and buses, subways, bicycles, online car rides and even drivers can be directly used in China Unionpay Quick Pass. In Beijing and China Unionpay Quick Pass, there are U Hui tickets and cards to grab every week. For example, the "7-day U-ticket for the subway" has a 30% discount for ten times within one week after purchase, limited to two times a day, which basically covers my commuting time. Simply calculate an account, each one-way commuter subway ticket costs 7 yuan, and after a 30% discount, it will be 4.9 yuan, so I can save 84 yuan on commuting every month. It’s really flattering to save two movie tickets if you’re not careful.

It is understood that China Unionpay Quick Pass APP covers all online and offline consumption scenarios, and goes deep into the fields of transportation, retail, catering, cultural tourism, education, medical care, public payment and people’s livelihood. It has been connected to mainstream e-commerce and social platforms, and social transfer of online shopping is very convenient.

China Unionpay Quick Pass is a relatively convenient choice for people who have more credit cards and bank cards or want to save a little in their daily consumption.

At present, the penetration rate of mobile payment is gradually increasing, and the industry structure is relatively stable. Looking at the capabilities of various third-party mobile payment applications, it is close to homogenization. China Unionpay Quick Pass, who entered the company in 2017, took product innovation around user scenarios as the core breakthrough, and provided a systematic management scheme for user bank card management and payment with the help of China UnionPay’s profound technical skills and unique advantages, which made our credit card repayment and bank card transfer easier and more efficient.