China Wisdom Promotes Global Economic Governance Reform (Authoritative Forum)

On October 2nd, 2015, as a RMB clearing bank in Hungary, Bank of China held a launching ceremony in Budapest, Hungary. The bank became the first RMB clearing bank in Central and Eastern Europe.

People’s vision

The new immigrant village building (left) in Pajing Village, Meng wei county, Luang Prabang Province, Laos, built by China Power Construction Group Laos Southern Europe River Basin Power Generation Co., Ltd., has greatly improved the living environment of local villagers. The picture on the right shows the old house before relocation.

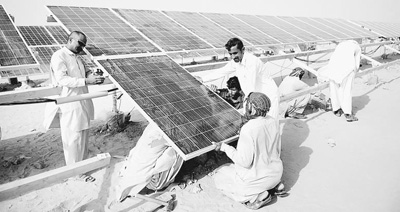

On August 27, 2015, local workers installed solar panels at ZTE’s 900 MW photovoltaic ground power station in Bahawalpur, Punjab, Pakistan. The total investment of the power station is more than 1.5 billion US dollars, which is one of the priority projects of the China-Pakistan Economic Corridor.

Xinhua news agency

Chen Jianqi (Deputy Director of the World Economic Office of the Institute of International Strategy of the Central Party School, main member of the G20 Finance and Economics Research Group of Peking University, G20 expert of the Ministry of Finance)

Xin li (doctoral supervisor of Beijing Normal University, main member of G20 Finance and Economics Research Group of Peking University, G20 expert of Ministry of Finance)

Li Yuanfang (Secretary-General, International Finance Research Center, Institute of World Economics and Politics, Chinese Academy of Social Sciences)

Advocate the construction of a new international financial order and transcend the existing conflicts of interest in terms of ideas and patterns.

Chen Jianqi: The International Monetary Fund (IMF) and the World Bank are two important international financial institutions at present. Together with GATT (the predecessor of the World Trade Organization), they constitute the three pillars of the Bretton Woods system. After World War II, the international financial system has been dominated by developed countries such as the United States, and this phenomenon has not changed substantially so far. Nevertheless, the progress made by China in recent years in promoting the adjustment of the international monetary and financial system and preventing global financial risks cannot be underestimated.

First of all, China, together with other emerging economies, called on international financial institutions such as the IMF and the World Bank to reform their governance mechanisms, so as to push the IMF to transfer more than 6% of the voting rights to emerging developing countries and countries that are under-represented, thus steadily increasing the voting rights of emerging developing economies. China’s voting rights in the IMF rose to the third place in the world. In recent years, China has repeatedly appointed personnel to hold senior official positions in the IMF and the World Bank, and the number of China employees in the two organizations has also increased. These changes are a more representative embodiment of the international financial governance mechanism.

Secondly, the internationalization of RMB accelerated last year, especially the entry into the SDR currency basket became a landmark event, which is of great significance for optimizing the international monetary system. The RMB exchange rate market fluctuated greatly in the second half of last year, but China took active measures to deal with the risks, and the current exchange rate has gradually shown two-way fluctuations. At the same time, China, together with other countries, advocated the implementation of responsible macro-policies through the G20 Summit to prevent countries from adopting competitive devaluation. All these are of positive significance to the current global financial governance and financial risk prevention.

Xin li: Since the international financial crisis, China has not only vigorously advocated the construction of a new international financial order on multilateral occasions, including the G20, but also put this idea into practice through its own actions. First of all, the AIIB is an important measure for China to improve the existing international financial order. The AIIB is not only widely representative, but also creates a new situation in promoting global financial cooperation, especially intergovernmental financial cooperation, which indicates that the international financial system has begun to issue the voice of China. Secondly, the establishment of RMB international settlement center, the opening of RMB cross-border payment system, and the entry of RMB into SDR currency basket all mark the steady progress of RMB internationalization. Thirdly, as a new mechanism created in the field of international finance, the BRICS New Development Bank is also a perfection of the old international financial order. Finally, Chiang Mai initiated the multilateralization mechanism and the establishment of the Macroeconomic Research Office (AMRO) between ASEAN and China, Japan and Korea (10+3), which became the "Asian version" of the International Monetary Fund and played the role of regional financial stability anchor.

At present, the international financial center is gradually shifting from the west coast of the Atlantic to the west coast of the Pacific. This means the change of the global financial system with the dissolution of old financial interests and the weaving of new financial interests as the main contents. China is actively participating in this change and actively safeguarding the fundamental interests of developing countries in the process.

Li Yuanfang: The international financial crisis in 2008 exposed the deficiency and inadaptability of the old global economic governance in solving global imbalances, stabilizing the global financial system and preventing global financial risks. The era of globalization and the global economic structure have put forward extensive reform requirements for global economic governance, including reforming the international financial institutions under the original Bretton Woods system to make them play more effective global functions; Reforming the international monetary system to reduce systemic risks and promote global economic development; Global cooperation strengthens the supervision of transnational financial institutions and prevents moral hazard.

The reform of global economic governance order involves the relative changes of existing rights and responsibilities of countries, which will inevitably lead to complex contradictions and conflicts. If it is not handled properly, the reform may be stagnant. At the same time, it takes time to develop more fair, just and effective global governance. How to make a smooth transition and gather determination and confidence for further development requires the guidance and efforts of key participants. Due to China’s huge size and rapid rise in the global economic system, China is a stakeholder and a key actor in the global economic governance transition, and faces very complicated relationship problems. From the current practice, we can see that China has responded to these challenges with a very positive and pragmatic attitude. On the one hand, it has maintained enough respect and attention to the existing order and institutions. On the other hand, it has never been passive at critical moments, dared to innovate, and surpassed the existing conflicts of interest in terms of ideas and patterns, forming a favorable reform situation.

Mechanisms such as the AIIB and the BRICS New Development Bank have made the multilateral financial system more perfect.

Chen Jianqi: Multilateral international financial institutions have become important financing platforms in terms of infrastructure gaps in major economies such as Asia and the promotion of global economic growth. However, multilateral financial institutions such as the World Bank and the Asian Development Bank mainly focus on poverty alleviation assistance, while multilateral development financial institutions such as the AIIB and the BRICS New Development Bank initiated by China focus on infrastructure, making the multilateral financial system more perfect.

The establishment of the AIIB gave birth to an Asian multilateral development bank system with the participation of developed countries outside the US-led system, and adjusted the ecology of Asian multilateral development banks dominated by the World Bank and the Asian Development Bank, which is of great significance to China’s participation in global economic governance.

Xin li: As a new regional international financial institution, the AIIB is not a substitute for the original international financial institutions, but a remedy for its deficiency in meeting the capital needs of developing countries. On the one hand, the AIIB is more open, free and inclusive. As an international multilateral financial institution spanning Asia, Europe and Latin America, the AIIB will undoubtedly have an impact on the dollar-dominated international financial system formed after World War II, and developing countries represented by China may become an important pole in the international financial system. On the other hand, the AIIB can help countries along the "Belt and Road" to continuously deepen interconnection construction, improve investment capacity and diversify investment risks in the "Belt and Road" region. "One Belt, One Road" is a new regional cooperation arrangement based on interconnection and aiming at regional common prosperity. Its concept of openness and tolerance determines that the AIIB will not only not challenge or replace the current international order, but also be able to work in parallel with the current regional economic cooperation mechanism and complement each other.

Li Yuanfang: It must be admitted that the reform process within the existing framework of global economic governance has greatly touched the old interests, so the reform is bound to be difficult and slow and needs a major opportunity to promote. The growth of emerging economies does not suddenly appear. China’s initiative of the AIIB and the BRICS New Development Bank jointly initiated by other BRICS countries are efforts to improve global economic governance outside the existing framework. On the one hand, they fill the gaps and shortcomings in the existing global economic governance, on the other hand, they are also of great significance to encourage and promote the reform and development of the original institutions.

The Asia-Pacific Free Trade Area has pointed out the direction for promoting the integration of rules in the field of international trade and investment.

Chen Jianqi: The 13th Five-Year Plan proposal comprehensively expounds China’s concept of promoting open development and achieving win-win cooperation from the aspects of perfecting the strategic layout of opening up, forming a new system of opening up, promoting the construction of the Belt and Road, actively participating in global economic governance, and actively assuming international responsibilities and obligations. Although specific governance rules related to win-win cooperation have yet to be formulated, it is certain that win-win cooperation constitutes the core thinking of China’s China plan to participate in global economic governance.

Xin li: Since the new century, the development of globalization is increasingly manifested in the refinement of different processes, sections and links in the process of product production and supply and the optimal allocation of spatial areas. In this process, the status of China and some emerging economies as "world factories" will continue to rise, and they will undertake more division of commodity production, thus demanding a larger world market. Economic and trade integration in the Asia-Pacific region came into being.

With the increasing global influence of China, it is bound to have broader and deeper economic and trade exchanges and cooperation with its trading partners. Allocating domestic and international resources and coordinating domestic and international markets will not only endow China’s economic development with richer connotations, but also profoundly affect the situation of economic globalization and multipolarization of the world economy. Therefore, it is not only in line with China’s interests, but also the practical needs of regional countries to achieve long-term development to establish a broader regional cooperation mechanism and promote the continuous extension of regional and even global production chains. The Asia-Pacific Free Trade Area advocated and promoted by China is more inclusive, which is a concrete measure for China to contribute "China wisdom" to build a new pattern of opening up the Asia-Pacific region and achieve win-win regional development.

Li Yuanfang: Due to the development of global value chain trade, the development of multilateral trade and investment governance framework such as the World Trade Organization (WTO) is facing more and more difficulties. At present, there is a trend of regional, bilateral and plurilateral trade and investment governance in the field of global trade and investment, and the fragmentation of governance rules in the Asia-Pacific region is obvious, with the emergence of the Trans-Pacific Partnership Agreement (TPP) promoted by the United States and the Regional Comprehensive Economic Partnership Agreement (RCEP) led by ASEAN and actively participated by China. If TPP is independent of the existing rules system and absorbs members on the new high-standard platform, RCEP is more integrated, open and gradual. This cooperation is committed to narrowing the development gap among participating countries and achieving maximum mutual benefit in the implementation of the agreement, taking into account high-level goals and gradual implementation. These are two different ideas, and the latter is more inclusive. There is a certain competitive relationship between them, but different ideas also mean that they have the potential of complementarity and strategic interaction.

The Asia-Pacific Free Trade Area promoted by China is not only compatible and coordinated with the WTO multilateral trading system, but also regards TPP and RCEP as possible realization paths, with higher-level integration, so as to unify the opening process of the Asia-Pacific region and reduce the market segmentation that may be caused by the fragmentation mechanism. This has pointed out an important direction for promoting the integration of rules in the field of international trade and investment.

The "Belt and Road" construction is an important practice of China’s characteristic openness.

Chen Jianqi: Promoting the "Belt and Road" construction is a concrete practice of China’s win-win cooperation and opening-up concept. While promoting the economic and trade development of countries and regions along the route, it is also expected to build a win-win regional governance system in this region. In the long run, the "Belt and Road Initiative" will inevitably face the problem of docking with TPP and the Transatlantic Trade and Investment Partnership Agreement (TTIP).

Xin li: From an economic point of view, the Belt and Road Initiative is not only conducive to the integration and development of China and countries along the Belt and Road, but also conducive to global economic recovery and sustainable growth in the post-crisis era.

On the one hand, the "Belt and Road" spans Asia, Europe and Africa and involves dozens of countries, connecting the active East Asian economic circle with the developed European economic circle. In fact, based on its existing economic aggregate, trade scale, foreign exchange reserves and increasing overseas investment and development financing, China can do more to promote the globalization process and improve the world economic governance system, and the implementation of the "Belt and Road" will play a positive role in this regard. On the other hand, the Belt and Road Initiative can promote regional economic integration through closer cooperation among countries, form new production networks and consumer markets, enhance the international competitiveness of industrial economies in Asian countries, and inject new impetus into global economic recovery in the post-crisis era.

Li Yuanfang: Under the background of weak global economic growth and the urgent need for a breakthrough, improving regional infrastructure and comprehensively promoting trade, investment and financial cooperation are of great value to improving the efficiency of regional resource allocation and promoting economic development. This is the fundamental reason why countries and regions along the "Belt and Road" have maintained very high attention and enthusiasm for it.

The "Belt and Road" construction is an important field to practice the openness with China characteristics of "co-operation, co-construction and sharing". In the process of transformation from a participant in the international system to a provider of public goods, China will inevitably face difficulties, such as investment income protection and investment security, financing channels and risk management, and relations with local governments and people. On the basis of learning from the experience of relevant countries, China adheres to the concept of common prosperity and solves these problems more creatively, which will not only bring remarkable economic achievements, but also contribute China’s best practices to global economic governance and support the substantive progress of bilateral and multilateral relations with concrete cooperation.

(Interviewed by our reporters Li Yan and Meng Xianglin)