Research on the depth of vehicle-cargo matching: how to integrate the scattered arteries

● Key points of investment

China highway logistics industry: the economic artery in urgent need of resource integration. China highway logistics freight volume accounts for 80% of the total freight volume, which is the main artery of China economy. However, the efficiency of the industry is not high. China’s trucks have an average effective mileage of 300 kilometers per day, while the United States can reach 1000 kilometers. There are more than 20 million trucks in China, and the empty rate is as high as 40% or more. The average interval between vehicle parking and distribution is about 72 hours. There are more than 7.5 million highway logistics enterprises in China, and each household only has 1.5 trucks, and more than 90% of them are in the hands of individual drivers. The crux of the current resource mismatch lies in the asymmetry of freight logistics information.

China Car-Goods Matching Market: Two Operating Models Coexist. Information asymmetry has given birth to the demand for matching between cars and goods. In the past, the traditional vehicle-cargo matching platform was mainly offline entities, including distribution stations, highway ports and logistics parks. At present, with the intervention of Internet, a virtual vehicle-cargo matching platform has been formed. By using the Internet, offline vehicle sources and goods sources are integrated through the development of logistics APP, WEB or other systems, and information is released online through APP, web or other systems and accurately matched, hoping to solve the asymmetry of logistics information.

Enlightenment from the development of American freight logistics industry. Truck transportation in the United States is extremely developed and is the main mode of transportation in the United States. Among them, truck transportation market scale exceeded US$ 600 billion, accounting for about 80% of the total. Developed infrastructure and high degree of intensification are the two main reasons for its high efficiency. The revelation of Robinson’s case is that the ability to integrate information and resources is the core. It does not own a truck, but it is the first truck transportation company in the United States, which basically monopolizes most of the road transportation resources in the United States and ranks seventh in global freight transportation.

Future Outlook: The Ultimate Version of Car-Goods Matching? Highway ports are built to eliminate them. In the past year, more than 200 car and cargo matching apps have been produced, but there have been few successes. There are three bottlenecks: 1. It is difficult to standardize supply and demand information; 2. Lack of integrity certification system; 3. Vehicles tend to have a stable supply of goods, and shippers prefer a stable transportation capacity, which makes it difficult for existing software to get involved in the mainstream market. We believe that the highway logistics industry will have offline matching platforms such as distribution stations, highways and logistics parks for a long time, and they have the strongest ability to gather traffic and people in scattered industries. They have the strongest resources and ability to integrate and innovate, and the ultimate mode of their development is to eliminate intermediary matchmakers.

Investment strategy. We suggest paying attention to the distribution and integration of logistics park resources in the country to form the Chuanhua shares of highway port network. For details of Chuanhua shares, please refer to our in-depth report "Chuanhua Logistics-China Highway Integrators Reloaded into Battle" on July 3 this year.

Risk warning. The economic downturn has led to a decline in freight demand; The offline matching platform is invested too much; The promotion of value-added services failed to meet expectations.

● The following is the text of the report.

catalogue

1. China highway logistics industry: the economic artery in urgent need of resource integration …-3-

1.1. Current situation of highway logistics industry: Highway is the main form of goods flow, but its efficiency is low …-3-

1.2. Information asymmetry is the crux, and there is a huge demand for matching cars and goods …-4-

Second, the matching market of vehicles and goods in China: two major operating modes coexist …-5-

2.1. Two camps gave birth to two business models …-5-

2.2. Comparison of Typical Case Studies …-5-

Iii. International Experience: Enlightenment from the Development of Freight Logistics in the United States …-11-

3.1. Overview of American road freight industry: Truck transportation is the main mode of transportation …-11-

3.2, no car is better than a car, the inspiration of Robinson’s case: the ability to integrate information and resources is the core …

Fourth, the future outlook: the ultimate version of car and cargo matching? … – 15 –

4.1 What are the pain points of car-cargo matching? … – 15 –

4.2 What mode does road freight need? … – 16 –

4.3 Investment strategy …-16-

Risk warning …-17-

1、China highway logistics industry: the economic artery in urgent need of resource integration

Modern logistics industry is the basic industry and producer service industry of national economic development, which is connected with production and consumption at one end. Since 2007, the scale of domestic social logistics market has shown a steady linear growth. In 2013, the total logistics cost was 10 trillion, and in 2014 it exceeded 11 trillion. At present, the proportion of China’s logistics cost to price cost and GDP is much higher than that of developed countries. In 2013, the ratio of China’s total social logistics cost to GDP was 18%, which dropped to 16.6% in 2014, while it was only about 8% in western countries. The overall capacity of China’s logistics industry is obviously insufficient.

1.1. Current situation of highway logistics industry: Highway is the main form of goods flow, but its efficiency is low.

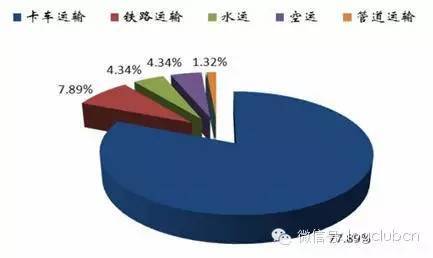

At present, the freight volume of highway logistics in China accounts for 80% of the total freight volume. Therefore, the reason why the overall logistics capacity of China is weak is the low efficiency of highway logistics capacity. At present, China’s trucks have an average effective mileage of 300 kilometers per day, while the United States can reach 1000 kilometers. There are more than 20 million trucks in China, and the empty rate is as high as 40% or more. The average interval between vehicle parking and distribution is about 72 hours. Among them, a lot of time is wasted on waiting for goods and distributing goods, which causes great waste of resources and inefficient tail gas emission, which intensifies air pollution; At the same time, it also increases the management pressure of expressways and urban roads.

1.2. Information asymmetry is the crux of the problem, and the demand for vehicle and cargo matching is huge.

Due to the small scale and large number of road freight operators, according to statistics, there are more than 7.5 million road logistics enterprises in China, and each household only has 1.5 trucks on average; However, its operation is basically in a state of "straggle", and the level of industry organization is very low. More than 90% of the transportation capacity is in the hands of individual drivers, and the industry concentration is only about 1.2%. We believe that the crux of the current situation of resource mismatch and inefficiency lies in the asymmetry of freight logistics information.

In the current freight logistics service chain, the individual car owners are at the end. Due to the low participation threshold of employees, oversupply and low organizational level, the game of these individual vehicles in freight transactions is very passive. Unless there are some structural reasons such as special time periods, special routes or special vehicle needs, the source and pricing power of most individual vehicles are often in the hands of shippers. In view of this, the vehicle-cargo matching market came into being. Under the current transportation market pattern of "more vehicles and less goods", its value lies in optimizing the resource allocation of goods and drivers in the downstream of the supply chain by virtue of the platform’s information integration ability, providing transportation capacity to shippers, providing goods to car owners and ensuring a certain freight rate, reducing the empty rate of vehicles, improving the efficiency of drivers in finding goods, and further reducing transportation costs. The high idle driving cost of truck drivers also makes the driver have a strong demand for the vehicle-cargo matching platform.

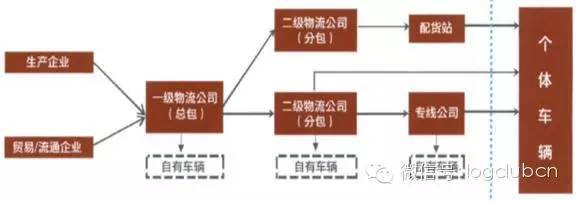

Schematic diagram of road freight service chain in China

Data source: Internet information, Industrial Securities Research Institute.

2. China’s car and goods matching market: two major operating modes coexist.

In fact, the vehicle-cargo matching platform is de-intermediated through the online platform. Internet technology and information technology are used to improve the information retrieval ability and matching efficiency, reduce drivers’ waiting time and empty driving distance, de-intermediate and improve the full load rate. Vehicle-cargo matching platform mainly uses the advantages of "internet plus", integrates off-line vehicle sources and goods sources through the development of logistics APP, WEB or other systems, and publishes information online through APP, web or other systems and accurately matches it, thus solving the asymmetry of logistics information.

2.1, two camps gave birth to two business models.

At present, there are two main models for the online and offline differentiation of the car and goods matching market:

Offline+Online mode: Offline is laid out nationwide, service nodes are established, local transportation resources are integrated, and a controllable transportation resource network is established to form a "transportation pool", on the basis of which vehicle and cargo matching services are provided online. The core of this mode is to integrate the vehicle and cargo resources, ensure the truthfulness, effectiveness and uniform service rules of the vehicle source information on the vehicle and cargo matching platform, and carry out vehicle and cargo matching on this basis.

Representatives: Chuanhua Logistics, Ka Xing Tian Xia, Anneng Logistics, Robinson Logistics of the United States.

Pure platform mode: The earliest pure platform mode was a short and simple freight information publishing website (such as Jincheng Logistics Network and National Logistics Information Network), and then it developed into an information transmission, matching and trading platform with software as the core, connecting the online and offline, connecting the consignor and the transportation capacity, and becoming a car-free carrier.

Representatives: oTMS, Driver’s Station, Yunmanman, Luoji Logistics.

2.2. Comparison of typical case studies

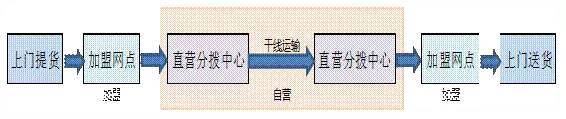

Chuanhua Logistics: Online Platform+Offline Highway Port Mode

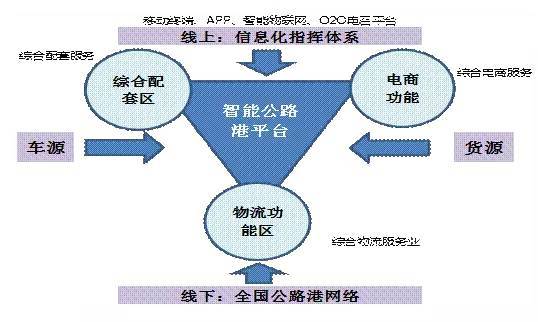

Chuanhua Logistics is actually a form of the fourth party logistics (4PL), which belongs to the online platform+offline highway port mode from the online and offline classification. Chuanhua Logistics entered the logistics industry in an all-round way from the modern logistics base in 2002, innovatively developed the "highway port" logistics platform, and established the closed-loop logistics ecology of O2O. In fact, the mode of uploading logistics is the fourth-party logistics mode, which realizes the integration of capital flow, information flow and logistics through the combination of online and offline. Offline, Chuanhua Logistics has established a national "highway port" logistics model, forming a national highway port network with 100 outlets in four major hubs. At present, it has occupied the card position advantage in key transportation hubs, and has rapidly expanded through the self-built and extended model. Online, Chuanhua has developed an Internet logistics platform with "Easy Distribution", "Barter Di" and "Yunbao Net" as its core. Through Chuanhua logistics portal+mobile phone distribution APP+ O2O truck calling platform in the same city, the freight problem between highway trunk lines and the city in the last mile has been solved. At present, Chuanhua Logistics has a revenue of over 10 billion yuan and is an invisible giant of China highway logistics.

Schematic diagram of online platform+offline highway port mode

Data source: Internet information, Industrial Securities Research Institute.

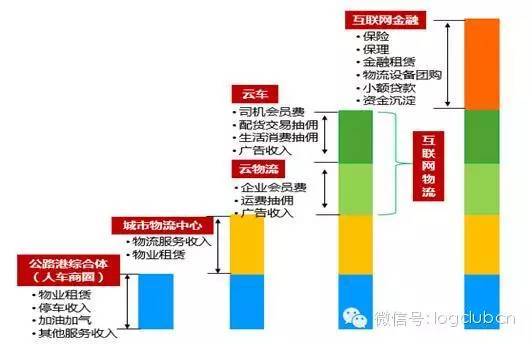

At present, Chuanhua Logistics has formed two major business segments: highway port investment operation and supporting services and O2O logistics network platform services. In the future, when the platform of Chuanhua Logistics grows to a certain scale (the main indicators are the number of active members and the total transaction amount), more profit models will be generated. Generally speaking, the main profit sources of Chuanhua Logistics in the future can be divided into: infrastructure rental income of highway ports, commission income of various logistics transactions, membership service income and financial services based on traffic and big data. Among them, the aforementioned fourth income will constitute the main profit model under the future logistics big data economy, such as personalized insurance group purchase income based on driver membership and behavior data, and logistics scale intensive income based on the whole network supply transaction.

Schematic diagram of profit model of Chuanhua Logistics

Source: official website, Industrial Securities Research Institute.

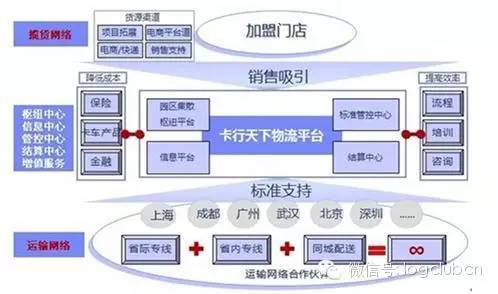

Card line in the world: online portal+offline joining mode

The operation mode of Card Bank is divided into two parts: offline transportation network and online portal network construction. Offline, by first establishing a regional center for goods collection and distribution, and at the same time, through the network radiation ability of this center, we will establish franchise outlets outside the park by joining to attract high-quality special line members, and finally build a nationwide logistics and transportation network. On the online side, through the construction of the portal website, we can provide a unified information system for the franchised enterprises, realize the tracking statistics, assessment and evaluation of the franchised enterprises, make the whole process of transportation services visible online, make the service settlement completed by platform members more convenient, improve the customer experience of delivery, and make the whole logistics chain run in a standardized way.

In terms of profit model, the Bank of China makes profits by charging initial fees, management fees and providing value-added services. The card bank charges a certain joining fee to the joining members. After the members join the card bank, the card bank charges management fees and system usage fees for 1% of the new business volume of the members. The profit of value-added services in the supply chain is mainly the insurance of centralized procurement and the financial services provided, including the cost of intensive distribution operation of the park platform.

Schematic diagram of online portal+offline joining mode

Data source: Internet information, Industrial Securities Research Institute.

Anneng Logistics: Online Portal+Main Line Self-operated+Joining Mode

The mode adopted by Anneng Logistics is the mode of self-operated trunk line and regional joining: the national distribution and trunk feeder buses are directly invested by the headquarters to ensure the operational stability and sustainability of the whole system to the greatest extent. By establishing the franchise mode of terminal outlets through online portal, franchisees can apply for joining on the website, thus avoiding the investment in building national outlets, concentrating on customer service in their own regions, and minimizing the risk of individual LTL express joining entrepreneurs. At the same time, customers can directly order delivery, waybill inquiry, order inquiry, order management and other services through the portal.

Schematic diagram of online portal+offline self-operation+joining mode

Data source: Internet information, Industrial Securities Research Institute.

At present, Anneng Logistics has established more than 130 distribution centers nationwide, with 8,000 staff and 5,000 outlets, serving 31 provinces and cities nationwide, planning more than 2,000 transportation routes and controlling more than 4,000 box trucks. It is estimated that by the end of 2015, Anneng Logistics will have more than 10,000 nationwide network points and 157 distribution centers, achieving the annual target turnover of 2.4 billion yuan and becoming the largest LTL logistics enterprise in China.

In terms of profit model, Anneng Logistics makes profits by collecting venue rent, joining fees and providing value-added services. On the one hand, by constantly eliminating unqualified networks and attracting new franchise outlets, and maintaining the gradual improvement of the quality and quantity of outlets, Anneng can provide brand support and certain source information for franchisees, and make a profit by charging franchisees a certain franchise fee. On the other hand, as the core product of Anneng Logistics, "Timing Arrival" provides customers with "safe, punctual, service and economical" road transportation services, with the service quality comparable to that of aviation and express delivery, and the price is only one third; At the same time, Anneng provides customers with services such as to pay the freight, receipt recovery, quotation claim settlement, etc., and makes profits by charging a certain value-added service fee.

OTMS: Community Platform Model

OTMS is a community-based transportation management system, which seamlessly connects the owner, the third-party logistics company, the transportation company, the driver and the final consignee from the top of the transportation chain, pays attention to the whole chain of transportation management, and forms a balanced and win-win online ecosystem based on the core process, which is equivalent to an online mirror image of its offline actual operation network. This online ecosystem will be an open community based on the credit system (real data). All community members can better manage their existing businesses and have the opportunity to find better resources or more new businesses. OTMS will not be involved in the actual operation, such as being a fourth party logistics company (4PL), and oTMS is just a community platform based on core software.

At present, there are 130 consignors in oTMS, and the consignors connect drivers through "Where are you" and "Kaka". Logistics companies use oTMS products to manage transportation orders, and the monthly orders are about one million.

Schematic diagram of community platform mode

Data source: Internet information, Industrial Securities Research Institute.

At present, oTMS has a Saas service platform with the main version of goods, a Saas service platform with the carrier version, an APP "Kaka" used by truck drivers, and an APP "Where is it" for the consignee to monitor logistics information. The transparent information management platform of the whole process formed by the combination of PC-side service platform and mobile APP brings all relevant parties, including consignors, logistics companies, transport carriers, drivers and consignees, into a business network, realizing the unification of tools.

In terms of profit model, oTMS currently focuses on selling Saas service systems and system maintenance services, and will get involved in the logistics finance industry in the future. In the B2B logistics and transportation industry, China still has a lot of room for growth, and B2B logistics and transportation also involves the cash flow of delivery enterprises, receiving enterprises and logistics companies. The accounting period of transportation companies is about 60 days to 120 days. How to participate in it and integrate this cash flow with financial institutions is the focus of oTMS’s future development.

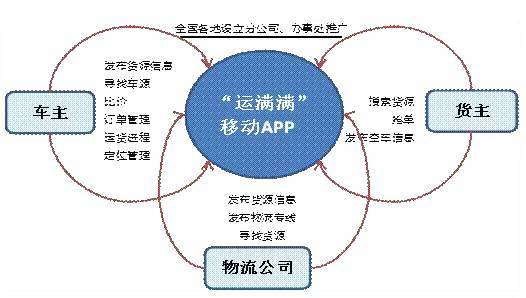

Yun Man Man: Mobile phone logistics information matching platform model

Yun Man Man is a mobile phone online logistics information matching platform based on mobile Internet technology, which is dedicated to providing efficient vehicle management and distribution tools for road transport logistics industry, and providing comprehensive information and transaction services for vehicle finding (distribution) and vehicle finding (consignment). Its service targets cover all types of goods and vehicles, meet the needs of logistics companies, information departments and small and medium-sized enterprises for long-distance road vehicle transportation, and at the same time improve the distribution efficiency of car owners and reduce the empty return rate; Improve the efficiency of cargo owners in finding cars and improve the operational efficiency of the overall logistics industry.

At present, Yunmanman has branches and offices in Jiangsu, Zhejiang, Shanghai, Anhui, Henan, Shandong, Fujian and other provinces, and plans to open more information on vehicle sources and goods sources and lay out the national road transport information network, so as to promote the road transport industry in China to enter an era of mobile Internet with high efficiency and low altitude.

Schematic diagram of mobile phone logistics information matching platform mode

Data source: Internet information, Industrial Securities Research Institute.

Through the "Yun Man Man" mobile APP, the owner can publish the information of goods supply and price comparison, and at the same time, he can also find the source of the car himself. With the permission of the driver, the driver can be located and managed to quickly understand the supply dynamics. The owner can search for the source of goods independently, compare the sources of goods, and contact the owner directly by telephone after finding satisfactory information. Car owners can also take the initiative to release empty car information and wait for the owner to come to the door. And logistics companies can also publish the information of goods supply and their own logistics lines, find the goods supply while knowing the freight price of vehicles in time, and further expand the online goods collection business.

At present, Yunman is not profitable. After building the whole ecosystem and attracting enough user traffic, Yunman can collect enough information, establish a credit system through big data, further improve payment and financial value-added services, and make profits through capital precipitation and value-added services.

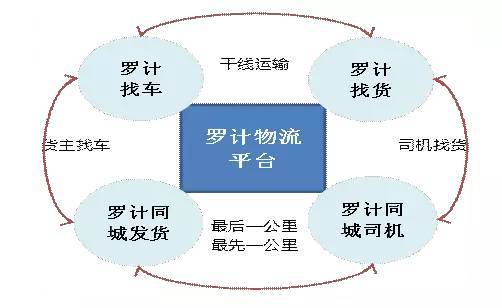

Luoji Logistics: Online Logistics Information Matching Platform Model

The Luoji logistics platform is similar to the mode of "Yun Man Man", and it is also an online logistics information matching platform. It uses data mining technology, search matching technology and mobile Internet of Things technology to provide drivers and shippers with free information on the source of goods and vehicles, and carries out multi-dimensional matching between goods and car owners, in addition to distance matching based on geographical location, there are also multi-dimensional matching such as route, time and load capacity. Luoji logistics platform realizes de-intermediation through the mobile Internet, which reduces logistics costs, the empty rate of trucks and improves the overall logistics efficiency. With the more registered users of platform owners and cargo owners, the success rate of vehicle-cargo matching will be higher and higher. By the end of 2015, the number of users on the Luoji platform will reach 4 million, including 3 million drivers and 1 million shippers.

Luoji logistics platform can solve the two problems of truck drivers and suppliers: first, quickly and effectively integrate the supply and capacity, and reduce the owner’s empty driving rate; The second is to make the freight market more orderly and smarter. At present, Luoji Logistics APP is divided into four versions: Luoji Looking for Goods (Driver Edition), Luoji Looking for Cars (Shipper Edition) and Luoji City (Delivery/Driver End).

Schematic diagram of Logitech logistics information matching platform model

Data source: Internet information, Industrial Securities Research Institute.

Logitech has launched two different softwares for shippers and car owners, "Logitech Find Cars" and "Logitech Find Goods". The truck driver opens the "Luo Ji Looking for Goods" and clicks the "List of Goods" to see the geographical location, goods type, weight, delivery time and vehicle demand of the goods, and the owner will dock the consignor as required. The barter between Luoji City and Chuanhua Logistics is similar, which mainly solves the transportation demand of the last kilometer and the first kilometer in the same city.

Similar to Yun Man Man, Logitech is not profitable at present, and its main task is to promote users. After the platform is formed, it collects huge data to realize its traffic value. For example, there can be derivative insurance services, refueling services, auto repair services, etc. on the platform, which are all potential value-added spaces. On the other hand, Luoji will consider further extending its business to the financial leasing of vehicles and supply chain finance of logistics companies.

3. International experience: Enlightenment from the development of American freight logistics industry.

3.1. Overview of American road freight industry: Truck transportation is the main mode of transportation.

Truck transportation in the United States is extremely developed and is the main mode of transportation in the United States. In 2011, transportation market scale in the United States was about 770 billion US dollars, of which truck transportation market scale exceeded 600 billion US dollars, accounting for about 80%. The volume of transportation and the value of goods delivered account for 70% of the total. The turnover of goods is second only to railway transportation, with an average annual growth rate of 2.5%, which is much higher than the overall growth rate of 0.8%, making it the fastest-growing sector.

The trucking market accounts for about 80% of transportation market scale.

Source: DOT, Industrial Securities Research Institute.

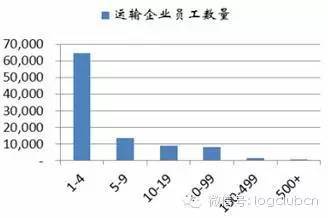

At present, there are nearly 100,000 transportation enterprises in the United States with more than 1.3 million employees, of which more than 90% have fewer than 20 employees, and there are only more than 600 transportation enterprises with a scale of more than 500 employees, accounting for less than 1%. The fleet size is generally small, and more than 50% of the transportation enterprises are Owner-Operator, that is, there is only one truck, and only 6.3% of the enterprises have more than 100 trucks. This is similar to the main business situation of China freight market at present.

Number of employees in American transportation enterprises

Fleet size of American transportation enterprises

Source: US Department of Commerce (DOC), Industrial Securities Research Institute.

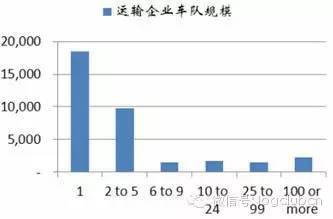

American trucking carriers are divided into non-public carriers and public carriers. Non-public carrier (In-Housefleet) means that production and retail enterprises own transport vehicles and operate them to meet their own transport needs, and generally do not provide transport services to the outside world. PublicCarriers are engaged in commercial transportation, and for the purpose of making profits, they are entrusted by the owner to provide transportation services and get paid.

American trucking market participants

Source: Industrial Securities Research Institute

According to the mode of transportation, public carriers can be divided into vehicle transport enterprises, LTL transport enterprises and road freight forwarders. The first two are truck companies based on heavy asset fleets, represented by YRCW and FedexFreight; The other is the road freight forwarder represented by Robinson Global Logistics. Many individual carriers provide transportation services for customers through the sales end of road freight forwarders or by joining large truck companies.

It can be seen that the developed infrastructure and high degree of intensification are the two major reasons for the high efficiency of highway logistics in the United States.

3.2, no car is better than a car, the inspiration of Robinson case: the ability to integrate information and resources is the core.

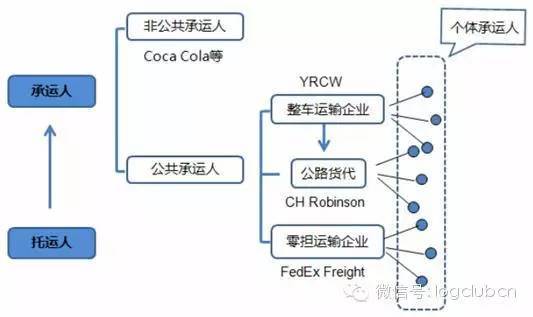

Robinson Logistics, founded in 1905, is the largest fourth party logistics company in the United States. The company is the representative of American car-free carriers. It doesn’t own trucks, but serves large shippers through the integration of many small and medium-sized fleets. Relying on value-oriented value-added services, exquisite business operations and advanced information systems, it has integrated 63,000 carriers and 46,000 shippers. In 2014, its operating income reached 13.471 billion US dollars, of which 80% came from road freight. At present, Robinson Logistics has become the first truck transportation company in the United States, basically monopolizing most of the road transportation resources in the United States, ranking seventh in global freight transportation; There are more than 218 branches in the world, of which the United States accounts for 158.

Robinson car-free transport mode

Source: Industrial Securities Research Institute

Robinson takes a completely light asset route. Instead of investing money in buying trucks and building logistics real estate, Robinson invests capital in the field of information technology, establishes TMS and Navisphere information platforms, and controls the transportation capacity through the information platform and remotely signs a cooperative enterprise logistics warehouse. By setting up technology-led outlets and branches offline, the online information platform will be connected with the needs and information of customers in offline areas. As a light asset enterprise, its human expenditure has also been greatly reduced. In 2014, Robinson only had 11,000 employees. Debon Logistics in China has more than 30,000 employees.

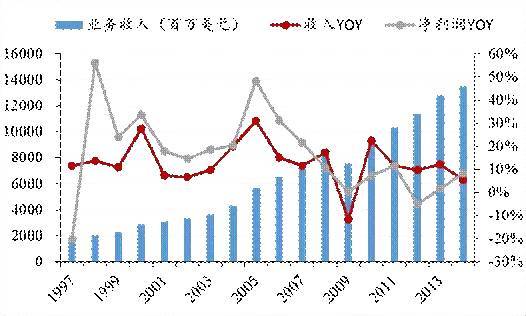

Robinson’s light asset operation mode and mature management mode make it have strong growth. Since the company went public in 1997, the average annual growth rate of main business income is 12.6%, while the average annual growth rate of net profit reaches 17.8%. In most years, the company’s net profit growth rate is higher than the income growth rate, and the company’s performance has the potential for sustained growth. Therefore, the development of the company does not need to be based on asset expansion, but by integrating local transportation resources, exporting technology and management, and opening up new customer markets, it will bring profits and long-term growth to the company.

The compound growth rate of the company’s net profit is higher than the income growth rate.

Source: Bloomberg, Industrial Securities Research Institute.

As the world’s largest fourth-party logistics company, Robinson’s revenue mainly comes from providing transportation and logistics services to suppliers, consulting services and payment services to customers. Robinson builds his value-added service system, such as supply chain analysis, transportation optimization, carrier management, big data services and business intelligence, and meets the needs of shippers and carriers through these high value-added solutions. Robinson does not charge the franchisees on the platform the joining fee, but charges the corresponding service fee through the solutions for different customers.

4. Future Outlook: The Ultimate Version of Car-Goods Matching?

4.1 What are the pain points of car-cargo matching?

The large-scale success of taxi-hailing software has made various funds intensively lay out the platform for car-cargo matching in the logistics industry, hoping to create a "drip taxi version of freight". According to incomplete statistics, more than 200 car-cargo matching APP taxi-hailing applications have been produced in one year, but there are few successful cases. Most car-cargo matching software has been criticized for relying on subsidies, untrue freight information and complicated transaction processes. Judging from the current situation, the reasons for the slow development of vehicle-cargo matching software are as follows:

1. Supply and demand information is difficult to standardize.

The information of the supply and demand sides in the taxi industry is very standard: cars are all cars with similar shapes, and the demand is the displacement of people, so it is very easy for the supply and demand sides to meet each other through the Internet.

However, when it comes to freight, the situation is much more complicated. Cars are different in length, load and power, and goods are also different in size and physical and chemical properties, which makes online matching much more complicated. Even if the information can be roughly matched, some personalized needs must be met and discussed (an interesting case: a consignor has a batch of fresh fruits to be transported, and a truck with the required load and size is found through the car-goods matching app, so that the driver can drive the car to the designated place. As a result, the consignor immediately cancels the intention because the truck has just been transported. Therefore, we see that many apps now only stay in the step of publishing information, and it is difficult to reach a trading intention without meeting.

2. Lack of integrity certification system

Road freight is a mixed market, and the general quality of employees is not high. It is difficult for many vehicle-cargo matching platforms to grasp the capital flow of freight transactions, because the proportion of logistics freight to the value of goods is still relatively low, and people are more accustomed to the traditional mode of paying with one hand and delivering with one hand.

3. Vehicles tend to have a stable supply of goods, and shippers prefer a stable transportation capacity, which makes it difficult for existing software to get involved in the mainstream market.

The capacity of individual trucks of about 14 million in China has seriously exceeded the demand for relatively scarce goods. At present, the trend of highway logistics is that vehicles tend to cooperate for a long time to ensure their high operating costs, so more and more individual vehicles are linked to the fleet; Shippers also tend to find long-term transportation capacity to ensure the stability of their logistics operation. And this long-term cooperative relationship has been established slowly, so the car-goods matching software has actually intervened in a relatively marginal market. Because of this, we will see more false information on the software, because the scarce real demand has already been spontaneously matched offline.

4.2 What mode does road freight need?

At the beginning of the report, we mentioned that the reason for the low efficiency of road freight transportation is information asymmetry. Therefore, the ideal state is that the waste of resources is zero: as soon as the goods leave the factory, there is a truck waiting at the door; And the truck will never be empty or stop for nothing, it will always go from A to B to C to D …, and it will be fully loaded in the process. In this ideal state, there will be no intermediary matchmaker and resources will match spontaneously. This is the ultimate mode of road freight.

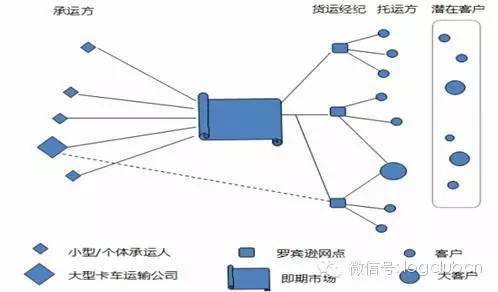

However, under the condition that the current technology has not reached the above level, offline matching platforms such as distribution stations, highways and logistics parks will exist for a long time. The reason is that it is difficult to standardize the freight supply and demand information we mentioned earlier, and the matching platform must have physical entities that enable both parties to meet. This makes these offline matching platforms naturally have the ability to gather people and traffic, and only when they carry out technological innovation and model innovation with real matching scenes can they promote the transformation and development of the road freight industry. Just like our comment on the highway port: "The construction of the highway port is to eliminate the highway port in the future".

4.3 Investment strategy

According to our judgment, the highway logistics industry will have offline matching platforms such as distribution stations, highways and logistics parks for a long time, and they have the strongest ability to gather traffic and people in scattered industries. That is to say, they have a strong premium ability to shippers and car owners. As long as these offline entities try to continue to cut into the deeper value-added and financial needs of shippers and car owners, the profit model will continue to innovate.

In view of the fact that there are regional offline matching entities all over the country, we suggest paying attention to Chuanhua, which can take the lead in arranging and integrating the resources of logistics parks nationwide to form a highway and port network.

For details of Chuanhua shares, please refer to our in-depth report "Chuanhua Logistics-China Highway Integrators Reloaded into Battle" on July 3 this year.

● Related reading:

In the era of big data, the car-goods matching logistics APP triggered a big change.

However, the combination of eggs: the matching of vehicles and goods can not solve the problem of logistics park

Note: The content of this article is reproduced from other media, please respect the copyright and keep the source, and bear all legal responsibilities. Truck House published this article for the purpose of transmitting more information, which does not mean agreeing with its views or confirming its description, nor does it mean that this website is responsible for its authenticity. If you have any questions or doubts about the content of this manuscript, please contact Truck House immediately, and this website will give you a quick response and handle it.