Answers to the Questions on Non-contact Online Tax Payment of Tibet Taxation

In order to actively respond to the pneumonia epidemic in novel coronavirus and minimize the spread risk of the epidemic, the Taxation Bureau of Xizang Autonomous Region City, State Taxation Administration of The People’s Republic of China, according to the principle of "doing it online as much as possible", and aiming at the hot issues of online taxation that taxpayers are concerned about, compiled the "Answers to Hot Issues of Non-contact Tax Payment in Tibet Taxation". Taxpayers can rely on three types of "non-contact" tax payment service channels, such as electronic taxation bureau of Xizang Autonomous Region Taxation Bureau, electronic taxation bureau of natural persons and social security fee management client of the unit, to handle all major tax-related payment matters.

[Answers to Hot Questions of Electronic Taxation Bureau]

1. How to quickly enter the electronic tax bureau to handle tax-related business?

A: Taxpayers visit the portal website of Xizang Autonomous Region Taxation Bureau (http://xizang. chinatax.gov.cn/) through the browser, and click "Electronic Taxation Bureau" on the home page to jump in. In case of any problems during use, you can directly call the hotline marked at the bottom of the homepage of the Electronic Taxation Bureau for consultation.

2. What tax functions does the electronic tax bureau mainly include?

A: The electronic tax bureau mainly includes five functions: My Information, I want to do tax, I want to inquire, Interactive Center and Public Service. Among them:

"My Information" is used to provide taxpayers with their own basic information and account management. Including taxpayer information, taxpayer electronic data access and maintenance, user management and user login and other specific functions.

"I want to pay taxes" is used to provide taxpayers with tax-related matters. Including taxpayer’s comprehensive information report, invoice use, declaration and payment of various taxes and fees, tax relief, certificate issuance, tax refund processing, tax administrative licensing, verification processing, VAT deduction voucher management, tax escrow fund collection, advance pricing arrangement negotiation and signing application, tax credit, tax-related professional service organization management, and legal accountability and relief matters.

"I want to inquire" is used to provide status inquiry to taxpayers. Including tax progress and result information, invoice information, declaration information, payment information, tax arrears information, preferential information, quota verification, violation of laws and regulations, certification information, tax-related intermediary information, tax credit status, electronic data and other specific functions.

The "interaction center" is used for information interaction between tax authorities and taxpayers. Taxpayers can get all kinds of news pushed by tax authorities and customized by taxpayers, as well as reminders involving risks, credit and to-do items; And realize online booking tax and tax collection interaction. Including my to-do list, my reminder, tax appointment, online interaction, tax evaluation, taxpayer demand and other specific functions.

"Public service" is used to provide taxpayers with services such as tax authorities’ notice and announcement, consultation and counseling, and public information inquiry, and can be used directly without registration and login. Including announcements, mainly including announcements of policies and regulations, announcements of major tax violations, announcements of A-level taxpayers with credit rating, announcements of tax arrears, and announcements of information of tax-related professional service organizations; Auxiliary tax, mainly including taxpayer school, tax policy and interpretation, tax guide, operating rules, download service, hot issues, key topics, tax map, tax calendar; Public information inquiry mainly includes invoice status, major tax violation cases, A-level taxpayers with credit rating, tax arrears, certification information, information inquiry of tax-related professional service institutions and other specific functions.

In addition, the electronic tax bureau also provides some one-click entry:

"My To-Do List" can provide information such as messages, notices, reminders of to-do items actively pushed by tax authorities to taxpayers.

"I want to make an appointment" can make an appointment for online and offline tax matters.

In the Notice Announcement, you can directly inquire about tax-related notices, important reminders, announcements and other documents and information issued by tax authorities to taxpayers and the public.

"Personalized service" can handle personalized tax matters such as tax packages, customized services and innovative services.

3. How to check the latest changes in the levy period and declaration period of various taxes and fees?

A: Taxpayers do not need to register and log in. They can check the start and end dates of tax declaration and payment by selecting "Public Service", entering "Consultation and Counseling" and then selecting "Tax Calendar".

4. If taxpayers have difficulties in filing, how can they apply for extension of filing?

Answer: After logging in, taxpayers can choose "I want to do tax" to enter "Approval of Taxpayers’ Delayed Declaration", fill in and submit the Approval Form for Delayed Declaration Application and the Application Form for Tax Administrative License. After the tax authorities have completed the examination and approval, taxpayers can obtain the information of the examination and approval results, and query and print the acceptance results. Taxpayers can also log in and select "I want to inquire" to enter the "information inquiry of tax progress and results" to inquire about the progress and results of handling.

5. If taxpayers have difficulty in paying taxes, how can they apply for an extension of tax payment?

Answer: After logging in, taxpayers can select "I want to pay taxes" to enter the "Approval of Taxpayers’ Deferred Payment of Taxes", fill in and submit the Application Form for Deferred Payment of Taxes and the Application Form for Tax Administrative License. After the tax authorities have completed the examination and approval, taxpayers can obtain the information of the examination and approval results, and query and print the acceptance results. Taxpayers can also log in and select "I want to inquire" to enter the "information inquiry of tax progress and results" to inquire about the progress and results of handling.

6. How do taxpayers apply for tax relief?

Answer: After logging in, taxpayers can choose "I want to pay taxes" and enter "tax relief" to handle tax relief filing and tax relief approval. After the completion of the tax authorities, taxpayers can obtain the result information, and query and print the acceptance results. Taxpayers can also log in and select "I want to inquire" to enter the "information inquiry of tax progress and results" to inquire about the progress and results of handling.

7. How can taxpayers apply for not adding late fees?

Answer: After logging in, taxpayers can enter the "general tax refund (credit) management" by selecting "I want to pay taxes", and then select "No application for late payment", fill in and submit relevant information according to the system prompts, upload the required information, and after the tax authorities have completed the audit, taxpayers can obtain the result information. Taxpayers can also log in and select "I want to inquire" to enter the "information inquiry of tax progress and results" to inquire about the progress and results of handling.

8. What matters can the newly-opened taxpayers handle in a "non-contact" way?

Answer: Newly-opened taxpayers can choose to enter the "Newly-opened Taxpayer Package Service" through the electronic tax bureau, and handle the registration and account opening of the electronic tax bureau, the confirmation of registration information, the filing of financial accounting system and accounting software, the account number report of taxpayers’ deposit accounts, the registration of general VAT taxpayers, the verification of invoice types, the examination and approval of the maximum invoicing limit of special VAT invoices, the real-name taxation, the initial issuance of special equipment for the VAT tax control system, and the receipt of invoices. In the specific handling, taxpayers can selectively complete the above-mentioned matters according to their own situation and relevant tips.

9. How do taxpayers apply for invoicing and voiding invoicing?

Answer: Small-scale taxpayers (including self-employed) who have registered for tax and other taxpayers who can issue special VAT invoices on their behalf can apply for issuing special VAT invoices by selecting "I want to do tax" after logging in.

For taxpayers who meet the conditions of issuing VAT general invoices, they can apply for issuing VAT general invoices by selecting "I want to do tax" and entering "Issuing VAT general invoices" after logging in.

After the issuance, the electronic tax bureau pushes information to inform taxpayers to collect invoices. If it is sent by mail, the tax authorities will push the distribution information to taxpayers.

After the tax authorities issue invoices on behalf of taxpayers, if the taxpayers need to void the invoices in case of sales return or sales discount, they can select "I want to do tax" after logging in, enter "Void Invoicing on behalf of taxpayers", and submit an application for void invoicing and relevant attached materials, which can be voided after the tax authorities complete the audit.

10. How to declare and pay VAT and additional taxes?

Answer: After logging in, taxpayers can complete the declaration and payment of value-added tax and additional taxes by selecting "I want to pay taxes", then selecting "Declaration of value-added tax and additional taxes (fees)". If multiple kinds of taxes and fees, such as value-added tax, consumption tax, additional tax (fee) and cultural undertakings construction fee, are involved, you can choose to enter the "Joint Declaration and Payment Package of Main and Supplementary Taxes" to complete the declaration of value-added tax, consumption tax, additional tax (fee), cultural undertakings construction fee and the corresponding tax (fee) payment.

11. How to declare and pay consumption tax and additional taxes?

Answer: After logging in, taxpayers can complete the declaration and payment of consumption tax and additional taxes by selecting "I want to pay taxes", then selecting "Declaration of consumption tax and additional taxes (fees)".

12. How to sign a tripartite agreement online?

Answer: After logging in, taxpayers can choose "I want to pay taxes", enter "Other Services" and enter the "Tripartite Agreement on Online Signing", and fill in and submit relevant bank information and taxpayer information. According to the prompt information, the taxpayer contacts the bank to complete the follow-up business. At present, some deposit banks can complete the tripartite agreement online signing.

13. How do taxpayers change their tax registration information?

Answer: Taxpayers can choose "I want to do tax" after logging in, and according to the taxpayer’s category, they can enter "one photo, one household information change", "two certificates integrated individual industrial and commercial households information change" or "tax registration information change", fill in and submit the Change Tax Registration Form and related attached materials to complete the change of tax registration information.

14. How do taxpayers apply for the qualification registration of VAT general taxpayers?

Answer: After logging in, taxpayers can select "I want to pay taxes", enter the "Comprehensive Information Report", then select "Qualification Information Report", enter the "VAT General Taxpayer Registration", fill in and submit the "VAT General Taxpayer Registration Form" to complete the registration of VAT general taxpayers. Taxpayers can log in and select "My Information" to enter "Taxpayer Information" to view the effective qualification information.

15. How do taxpayers apply for cancellation?

Answer: Taxpayers can choose to enter the Package of Tax Clearance and Cancellation (Fees) Declaration and Payment by logging into the Electronic Taxation Bureau, and complete the filing of enterprise income tax liquidation, the declaration of value-added tax and additional taxes, the declaration of consumption tax and additional taxes, the declaration of enterprise income tax, other declarations, comprehensive declarations, the submission of financial statements and the payment of taxes respectively according to the types of taxpayers.

16. How do taxpayers who need to cancel apply for the declaration and tax payment of the tax (fee) that should be declared in the cancellation period?

Answer: Taxpayers who have no outstanding taxes and fines and fail to declare within the time limit can choose to enter the "Package of Tax Clearance and Cancellation (Fees) Declaration and Payment" by logging in to the provincial electronic tax bureaus, and handle the current period [cancellation of the previous period of the current month (quarter, year), and the date of cancellation application is within the levy period declared in the previous period] and cancellation of the period [cancellation of the period of the current month (quarter, year)]. At the same time, for taxpayers who have identified corporate income tax categories, in addition to branches, they can also complete the enterprise liquidation income tax declaration.

17. What should taxpayers do if they need to adjust the regular quota?

Answer: If taxpayers need to adjust the fixed quota, they can choose "I want to do tax" after logging in, enter "Fixed-term households apply for verification and adjustment of quota", fill in and submit the Approval Form for Verification and Approval of Individual Industrial and Commercial Households’ Quota and related attached materials. After the tax authorities have completed the examination and approval, taxpayers can obtain the information of the examination and approval results, and view and print the acceptance results in the electronic tax bureau.

18. How do taxpayers apply for tax refund?

A: Taxpayers can enter the "General Tax Refund (Refund) Management" by selecting "I want to pay taxes" after logging in, and fill in and submit the Tax Refund (Refund) Application Form. After the tax authorities have completed the examination and approval, taxpayers can obtain the information of the examination and approval results. After logging in, taxpayers can also select "I want to inquire" of the electronic tax bureau and enter "Information Inquiry on Tax Progress and Results" to inquire about the progress and results of handling.

Taxpayers can apply for tax refund, which mainly includes: tax refund due to wrong collection and overpayment, tax refund due to warehousing reduction and exemption, tax refund due to overpayment of tax refund due to final settlement, tax refund for vehicle purchase tax, tax refund due to vehicle and vessel tax, tax refund due to remaining tax at the end of value-added tax, etc.

19. How can taxpayers issue tax-related certificates?

A: Taxpayers who need to issue tax-related certificates can apply for issuing tax-related certificates by selecting "I want to do tax" and entering "Certificate Issuance" after logging in.

Tax-related certificates that taxpayers can issue mainly include: tax payment certificate (documentary form), tax payment certificate (tabular form), China tax resident ID card, foreign payment tax filing for service trade and other items, transfer tax payment book (special for export goods and services), export tax refund (exemption) related certificates, etc.

20. How do tax agencies submit relevant information and materials to the tax authorities?

A: Tax agencies can choose to enter the "Management Package of Tax-related Professional Services" by logging in to the Electronic Taxation Bureau, and submit information such as institutions, personnel and entrustment agreements to the tax authorities.

The management package of tax-related professional service institutions includes: administrative registration of tax agency; Change and termination of administrative registration of tax agency; Basic information collection of tax-related professional service institutions (personnel); Information collection of tax-related professional service agreements; Information collection of tax-related professional services; Information change and termination of tax-related professional service agreement.

21. How to make an appointment for tax payment through the electronic tax bureau?

A: Taxpayers can make an appointment to pay taxes by choosing "I want to make an appointment" after logging in, or by choosing "Interactive Center" and entering "Tax Appointment" after logging in.

22. How to obtain all kinds of notices and announcements of tax authorities through the electronic tax bureau?

A: Taxpayers do not need to register and log in. They can choose "Public Service" and enter "Notice Announcement" to obtain various notice announcements issued by tax authorities.

The notice announcements provided by the Electronic Taxation Bureau mainly include the notice of policies and regulations, the notice of major tax violation cases, the notice of A-level taxpayers with credit rating and the notice of tax arrears.

23. How to check the online training issued by the tax authorities through the electronic tax bureau?

A: Taxpayers don’t need to register and log in. They can check the online training plan issued by the tax authorities by selecting "Public Service", entering "Consultation and Counseling" and then selecting "Taxpayer Academy". Taxpayers can set class reminders under this function and participate in online training in time.

24. How to check tax-related policies and interpret documents through the electronic tax bureau?

A: Taxpayers do not need to register and log in. They can choose "Public Service", enter "Consultation and Counseling" and then choose "Tax Policy and Interpretation" to view various tax-related policies and interpretation documents of tax authorities.

25. How do taxpayers upload, download and print their own electronic materials through the electronic tax bureau?

A: After logging in, taxpayers can select "My Information" and enter "Electronic Information" to consult, download and print the relevant electronic information generated by their own tax through the Electronic Taxation Bureau at any time. In the process of handling tax-related business, if taxpayers need to upload attached information, the electronic tax bureau will intelligently associate the electronic information that taxpayers have submitted or generated in the past, prompting the existing information in the electronic database for taxpayers to choose; At the same time, for the electronic materials that need to be supplemented, the data uploading function is provided.

26. How can taxpayers check the progress of the tax-related matters they apply for without going to the tax service hall?

Answer: After logging in, taxpayers can select "I want to inquire" and enter "Information Inquiry on Tax Progress and Results" to inquire about tax progress and results.

27. How can taxpayers query invoice information without going to the tax service hall?

Answer: After logging in, taxpayers can select "I want to inquire" to enter "Invoice Information Inquiry", select conditions such as the start and end date of issuance, the name of invoice type, etc., and can also export or print one or several pieces of invoice information.

28. How can taxpayers inquire about the detailed information of declaration through the electronic tax bureau?

Answer: After logging in, taxpayers can select "I want to inquire" to enter "Inquire about declaration information", and select conditions such as declaration date, tax date and declaration form type to inquire about the declaration information at the corresponding time. At the same time, you can further click to view the declaration form and attached information, and you can print or export it.

29. How can taxpayers check the tax payment through the electronic tax bureau?

Answer: After logging in, taxpayers can enter "Payment Information Inquiry" or "Tax Arrears Information Inquiry" by selecting "I want to inquire" and enter the inquiry criteria to inquire about the specific payment or tax arrears. If there is tax arrears, you can skip to the corresponding tax (fee) payment function module to pay tax arrears through the "Tax Arrears Payment" link provided by the system.

[Answers to Hot Issues of Natural Person Electronic Taxation Bureau]

30. Where can I download and install the natural person electronic tax bureau (withholding end)?

Answer: The natural person electronic tax bureau (withholding end) is applicable to withholding agents to withhold and remit personal income tax. Withholding agents can download it from the official website of Xizang Autonomous Region Taxation Bureau. The steps are as follows: Go to official website of Xizang Autonomous Region Taxation Bureau-click "Data Download"-click "Software Download"-click "Soft Link" of "Natural Person Electronic Taxation Bureau (Withholding End)" to download. After the download is successful, double-click the installation package and click Install Now to install the withholding agent to the local computer.

31. How does the natural person electronic tax bureau (withholding end) register?

A: After the system is installed, you need to register. The process of registration is roughly the process of obtaining the corresponding enterprise information from the tax system through the taxpayer identification number and saving it to the local withholding terminal. Specifically, click [Experience Now] on the installation completion interface (or click the shortcut of "Natural Person Electronic Taxation Bureau (withholding terminal)" on the desktop), that is, enter the registration process. There are five steps in registration: Step 1: Enter company information; The second step of registration: obtain tax information; The third step of registration: filing the information of tax payers; The fourth step of registration: set the login password; Registration Step 5: Set up automatic data backup.

32. How does the natural person electronic tax bureau (withholding end) update the tax information?

Answer: Click System Settings → Declaration Management → Tax Information Update → Download on the left side of the withholding software to indicate that the information has been obtained successfully.

33. The natural person electronic tax bureau (withholding end) made a backup on the original computer. Can the previous data be restored after replacing the computer? What should I do?

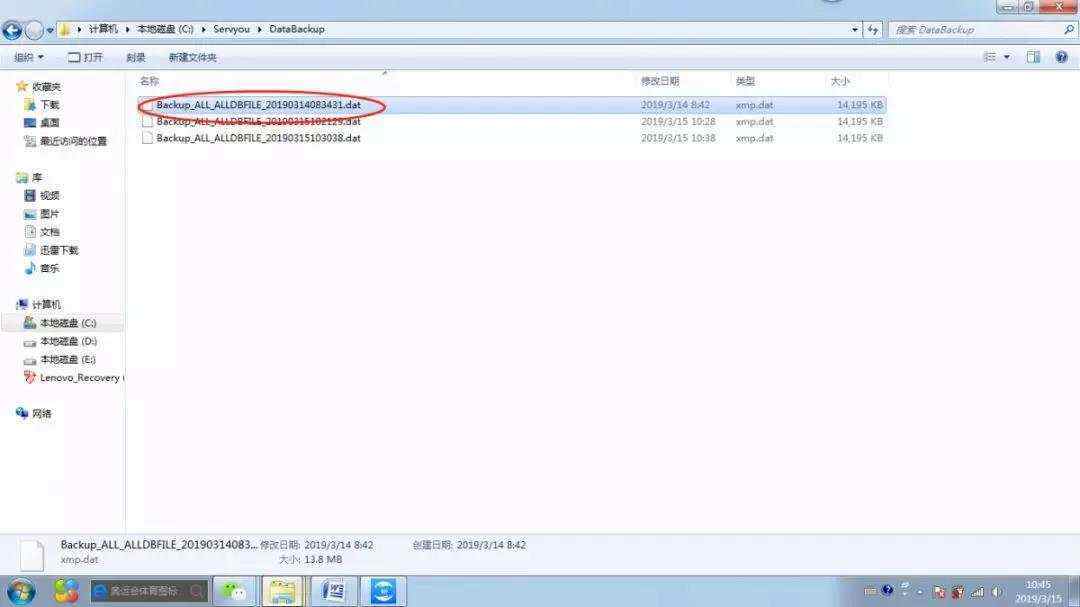

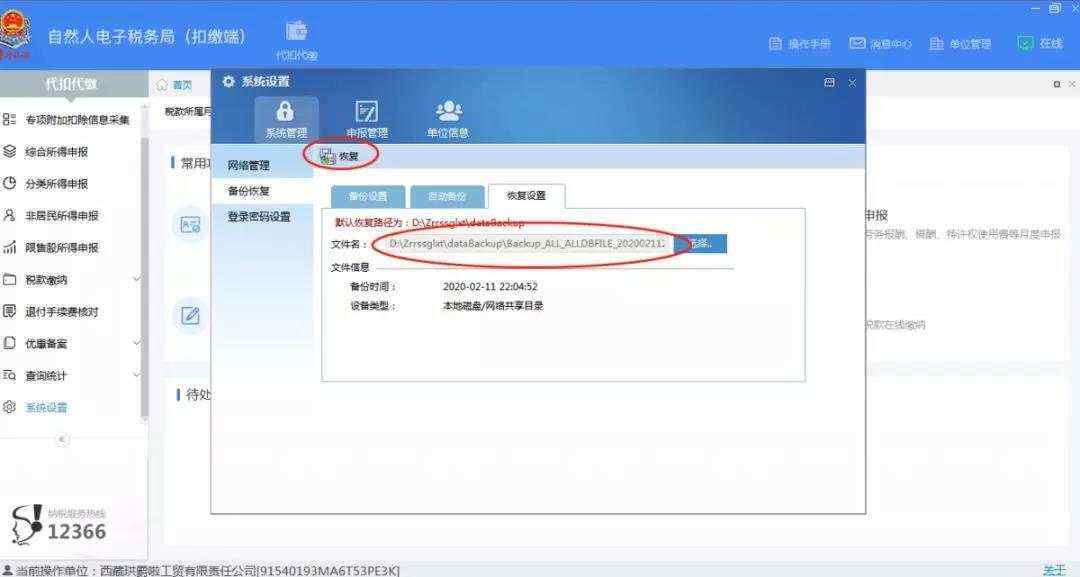

A: First of all, the data of the withholding end of the natural person electronic tax bureau exists on the local computer. After replacing the computer and reinstalling the client, the original data of the client will no longer exist. Therefore, it is suggested that the withholding unit must enable the automatic backup function when using the withholding end. The operation of the automatic backup function is as follows: after using the withholding terminal, directly click "X" in the upper right corner to exit, and click "OK" for the confirmation message that pops up. After clicking OK, the system prompts "Do you need to back up the database automatically?" , click "Yes", and the system will automatically back up the data. If the withholding company changes the operating computer and reinstalls the withholding terminal, the original data recovery operation is as follows: find the previous backup file on the original computer, and the path of the original computer backup data can be viewed by opening the withholding terminal on the original computer and entering System Settings-System Management-Backup Recovery-Automatic Backup.

After finding the backup file, copy it to any directory of the new computer, then enter the withholding terminal on the new computer, enter the system management-backup recovery-recovery settings, select the backup file, and click Restore to restore the original data of the withholding terminal.

After finding the backup file, copy it to any directory of the new computer, then enter the withholding terminal on the new computer, enter the system management-backup recovery-recovery settings, select the backup file, and click Restore to restore the original data of the withholding terminal.

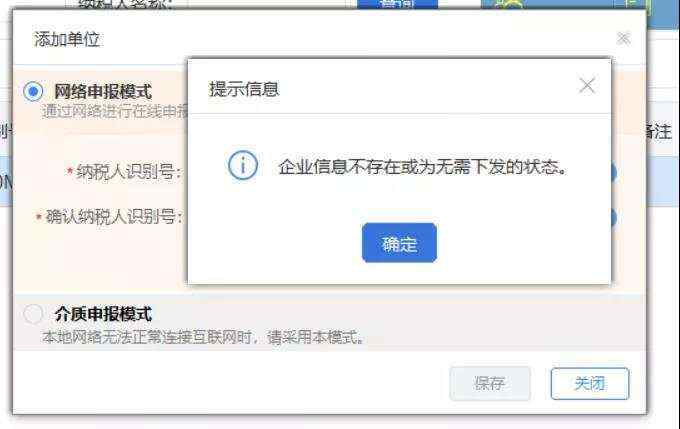

34. When logging in to the withholding end of the natural person electronic tax bureau, the registration system pops up a message that "enterprise information does not exist or is in a state that does not need to be distributed". What should I do?

Answer: This prompt message may be caused by the following reasons: (1) The taxpayer identification number is not entered correctly, so it is recommended to check whether the tax number is entered correctly. (2) For newly-established enterprises or enterprises that have changed their tax registration, the information is not automatically extracted into the tax background database in time. Please wait for one hour before logging in to the withholding terminal for operation. If the tax number is correct and the same question is still prompted after waiting for one hour, please contact the competent tax authorities or use the tax service center for online consultation.

35. What are the status of identity verification in the withholding end of the natural person electronic tax bureau? What’s the meaning?

Answer: [To be verified]: the default status when the personnel information is added or modified for the first time, which means that the withholding client has not initiated the verification of the taxpayer’s identity information; [Verifying]: It means that the resident identity registration information of the public security organ has not been obtained, and the system will automatically obtain the verification result without further operation; [Verification Passed]: It means that the collected personnel information is completely matched with the information of the public security system; [Verification Failed]: It means that the identity information of the natural person is inconsistent with the resident identity registration information of the public security organ, and the information needs to be verified and corrected correctly.

36. When uninstalling the withholding terminal and reinstalling it, you will be prompted with the following screenshot. How to solve it?

Answer: When uninstalling the withholding terminal, you must follow the standard uninstallation process of the operating system, that is, enter the control panel to uninstall. The error in reporting this screenshot is due to the use of quick uninstall tools such as 360. After uninstalling 360, a prompt "Do you want to delete the registry" will pop up without deleting it. The solution is as follows: delete the registry "HKEY _ current _ usersoftwareYouEPPortal _ DS 3.0". (win+R—regedit)

37. How can I get the declaration password if I forget it or register for the first time?

Answer: The application password has been forgotten and needs to be reset, or the application password obtained during the first registration has been greatly changed. In addition to going to the tax hall to reset the declaration password, there is also an additional channel, that is, self-reset through the company’s financial controller or legal person’s tax mobile APP or web terminal.

38. When the natural person tax management system is updated and other tax-free income is filled in, the exemption items will pop up. There is no tax-free deduction in the options. Which one should I choose?

A: Some individual income tax returns were revised according to the Announcement of State Taxation Administration of The People’s Republic of China on Revising Some Individual Income Tax Returns (No.46, 2019), so the system version was added with verification. When declaring normal wages and salaries, if "tax-exempt income" or "tax reduction and exemption" is filled in, the schedule of tax reduction and exemption must be filled in. Combined with the special policies of our region, when filling in the "tax-free income", select "qualified Tianjin subsidies are exempt from personal income tax" in the column of tax exemption in the schedule of tax reduction and exemption.

39. The natural person tax management system closes and opens the withholding client after reloading, and there is no declaration record?

Answer: The query statistics function does not update data in real time, and the synchronization time is T+1 mode, so you can’t see the declaration record immediately when you open it. The declaration data is processed every night, and the declaration records can only be found the next day.

40. The natural person tax management system has an interface related to personal income tax withholding fees. Can I apply for online return in the system?

A: According to the requirements of relevant policies, if the withholding agent or agent terminates the withholding obligation or the agent-collecting relationship during the year, they should submit the application materials for handling fees to the tax authorities within 3 months after the termination, and the tax authorities will handle the handling fees settlement.

The tax authorities will take the statement confirmed by the withholding agent as the basis for refunding the handling fee and automatically start the tax refund process.

[Answers to Hot Issues of Corporate Social Security Fee Management Client]

41. How do I download the client for reporting social insurance premiums?

Answer: It is necessary to declare and pay the social insurance premiums of government agencies and institutions, which can be declared and paid through the social insurance premium declaration client of the unit. You can log on to the portal website of Xizang Autonomous Region Taxation Bureau "Tax Service/Download Center/Software Download/"to download and install the social security fee declaration client.

42. How to use the client for reporting social insurance premiums of the company?

Answer: You can download the operation manual from the portal website of Xizang Autonomous Region Taxation Bureau "Tax Service/Download Center/Software Download/"and follow the operation manual.

43. What is the login user name and declaration password of the company social security fee declaration client?

Answer: The login user name is a unified social code. The declaration password is 6 digits after the unit social security code.